1. Concept & meaning, Different types of Debentures

CONCEPT & MEANING

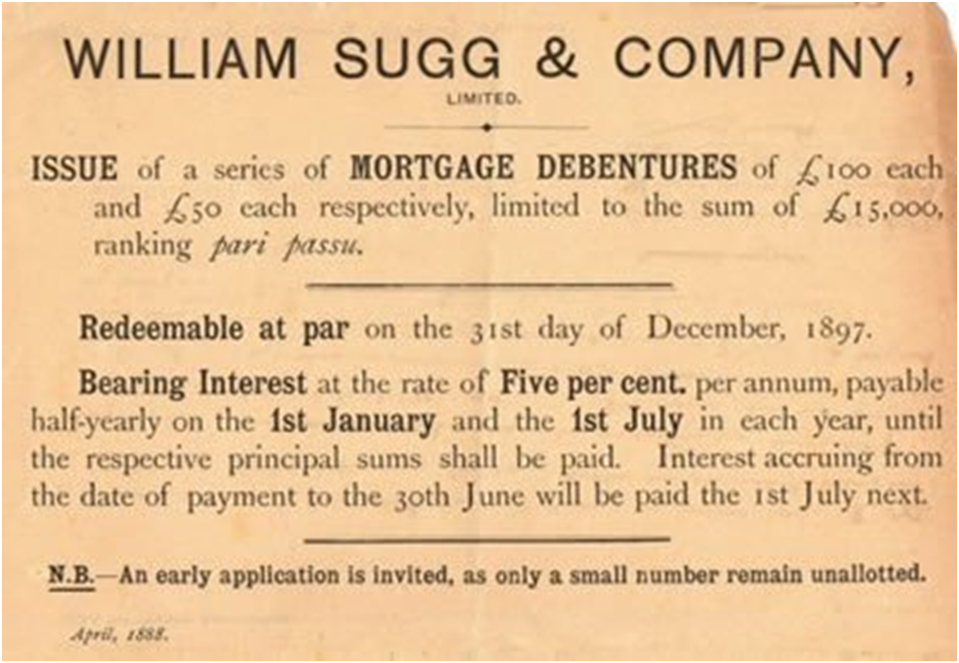

An acknowledgment of a debt is called a debenture. In India, debentures and bonds are treated as same. The difference lies in its issuance. When it is issued by private companies, it is called debentures but when it is issued by government companies, it is called bonds. Debentures basically include debenture stock, bonds and any other securities of a company whether contributing a charge on the company’s assets or not.

The debenture holders are paid a fixed rate of interest on their investments. If the debentures are secured, then they are given priority over other creditors in terms of payment of interest.

Debenture: A debenture is an acknowledgment of a debt. It is a source of long-term finance for the company. The debenture holders are treated as creditors of the company and are paid interest on their investment.

What Are Debentures?

The word ‘debenture’ is derived from the Latin word ‘debate’ which refers to borrow. A debenture is a written tool acknowledging a debt under the general authentication of the enterprise. It comprises an agreement for repayment of principal after a specific period or at the option of the enterprise and for payment of interest at a fixed rate, usually either yearly on fixed dates. According to section 2(30) of The Companies Act, 2013 ‘Debenture’ comprises – Debenture Inventory, Bonds and any other securities of an enterprise whether comprising a charge on the assets of the enterprise or not.

Different Types of Debentures:

1. From the Point of view of Security

- Secured Debentures: Secured debentures are the kind of debentures where a charge is being established on the properties or assets of the enterprise for the purpose of any payment. The charge might be either floating or fixed. The fixed charge is established against those assets which come under the enterprise’s possession for the purpose to use in activities not meant for sale whereas the floating charge comprises all assets excluding those accredited to the secured creditors. A fixed charge is established on a particular asset whereas a floating charge is on the general assets of the enterprise.

- Unsecured Debentures: They do not have a particular charge on the assets of the enterprise. However, a floating charge may be established on these debentures by default. Usually, these types of debentures are not circulated.

2. From the Point of view of Tenure

- Redeemable Debentures: These debentures are those debentures that are due on the cessation of the time frame either in a lump sum or in installments during the lifetime of the enterprise. Debentures can be reclaimed either at a premium or at par.

- Irredeemable Debentures: These debentures are also called Perpetual Debentures as the company doesn’t give any attempt the repayment money acquired or borrowed by circulating such debentures. These debentures are repayable on the closing up of an enterprise or on the expiry (cessation) of a long period.

3. From the Point of view of Convertibility

- Convertible Debentures: Debentures that are changeable to equity shares or in any other security either at the choice of the enterprise or the debenture holders are called convertible debentures. These debentures are either entirely convertible or partly changeable.

- Non-Convertible Debentures: The debentures which can’t be changed into shares or in other securities are called Non-Convertible Debentures. Most debentures circulated by enterprises fall in this class.

4. From a Coupon Rate Point of view

- Specific Coupon Rate Debentures: Such debentures are circulated with a mentioned rate of interest, and it is known as the coupon rate.

- Zero-Coupon Rate Debentures: These debentures don’t normally carry a particular rate of interest. In order to restore the investors, such types of debentures are circulated at a considerable discount and the difference between the nominal value and the circulated price is treated as the amount of interest associated with the duration of the debentures.

5. From the view Point of Registration

- Registered Debentures: These debentures are such debentures within which all details comprising addresses, names and particulars of holding of the debenture holders are filed in a register kept by the enterprise. Such debentures can be moved only by performing a normal transfer deed.

- Bearer Debentures: These debentures are debentures that can be transferred by way of delivery and the company does not keep any record of the debenture holders Interest on debentures is paid to a person who produces the interest coupon attached to such debentures.

2. Issue of debentures at a discount

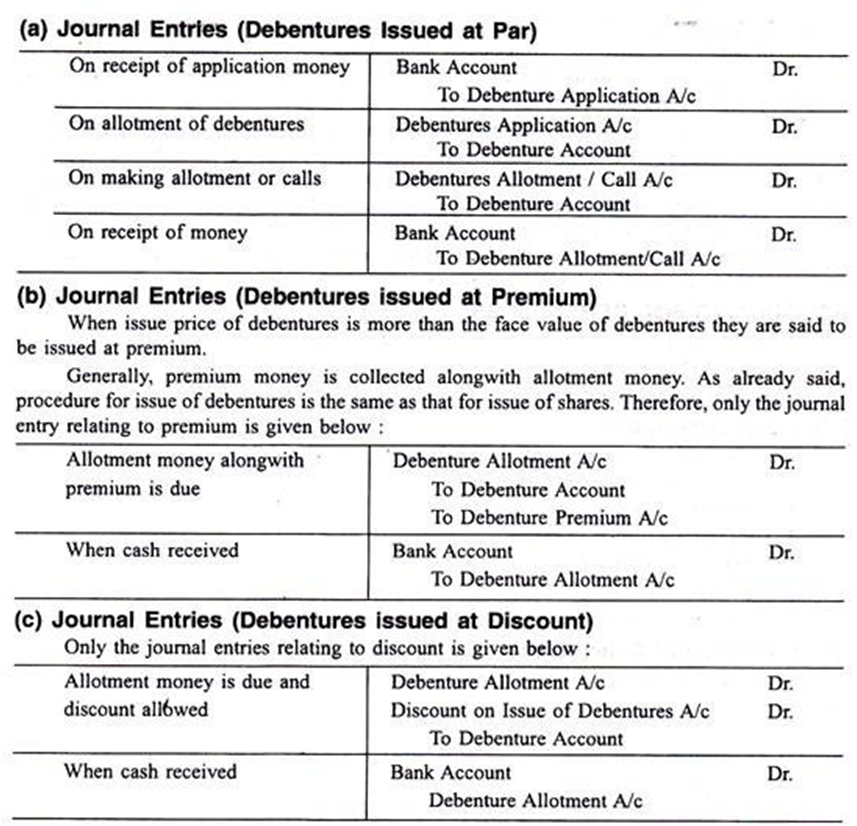

ISSUE OF DEBENTURES – JOURNAL ENTRIES

(A) Issue of Debenture for Cash:

The issuing procedure with regard to debentures is the same as that of shares. The amount due on debentures may be paid in installments, such as Applications, Allotments and Calls. When debentures are issued at premium, the amount of premium is credited to Debenture Premium Account. Debenture Premium Account is a capital profit and is transferred to Capital Reserve Account.

When debentures are issued at discount, the amount of discount is debited to ‘Discount on Issue of Debentures Account. The amount of discount should be shown on the asset side of the Balance Sheet, under the head ‘Miscellaneous Expenditure, until written off.

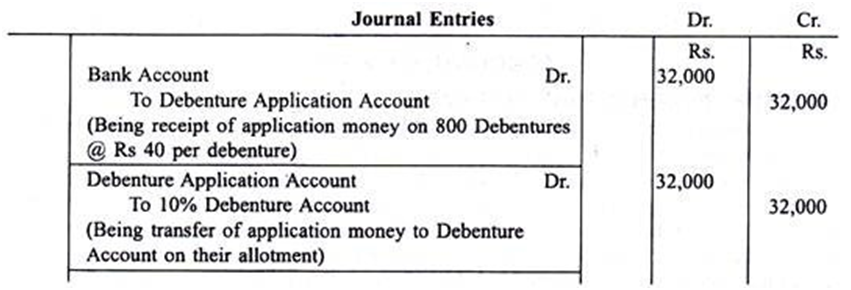

A company issued 1,000 10% debentures of Rs 100 each at par, payable Rs 40 on application and the balance on allotment. The public applied for 800 debentures. These applications were accepted. All money were received. Give journal entries.

Solution:

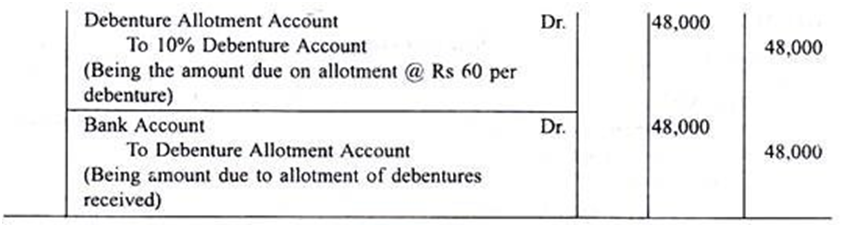

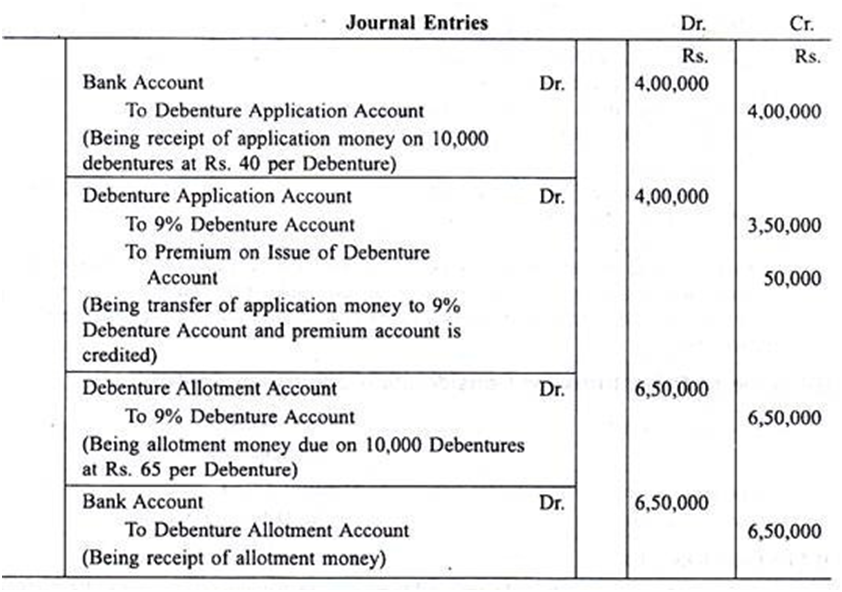

Illustration 2 (Issue of Debentures at Premium):

A company issued 10,000 9% Debentures of Rs. 100 each at a premium of Rs. 5, payable as follows:

On application Rs. 40 (including premium)

On allotment Rs. 65

All the Debentures were subscribed for and the money was duly received. Pass necessary journal entries.

Solution:

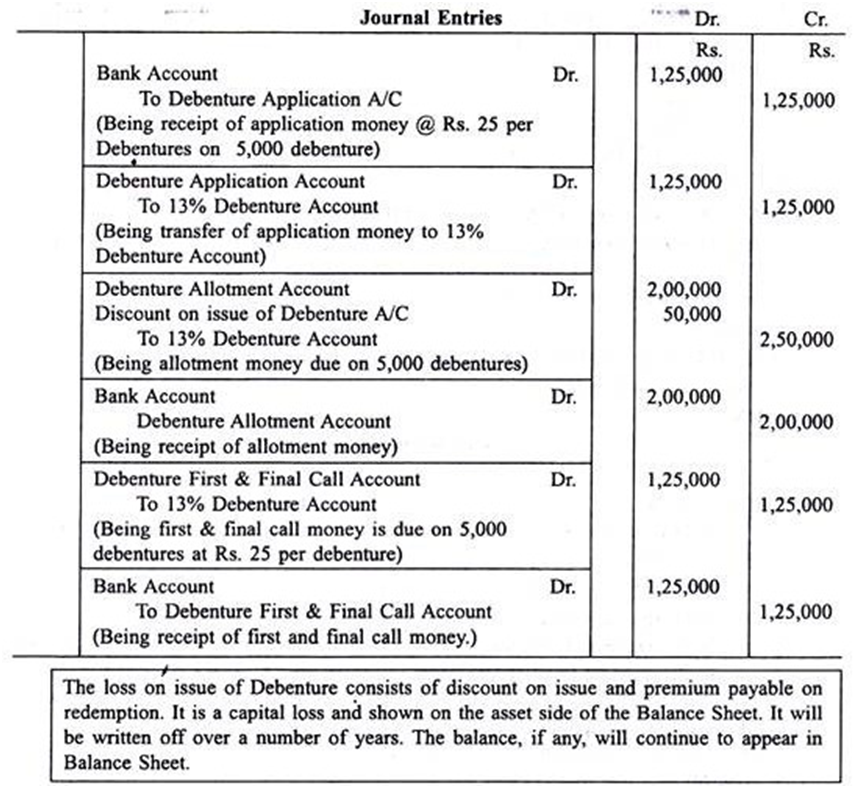

Illustration 3 (Issue of Debentures at Discount):

A company issued 5,000 13% Debentures of Rs. 100 each at a discount of 10% payable Rs. 25 on application. Rs. 40 on allotment and Rs. 25 on the first and final call account. The debentures were fully subscribed and the money due was duly received.

Solution:

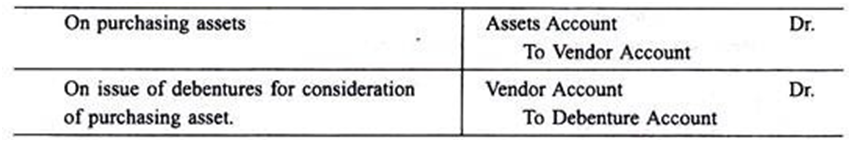

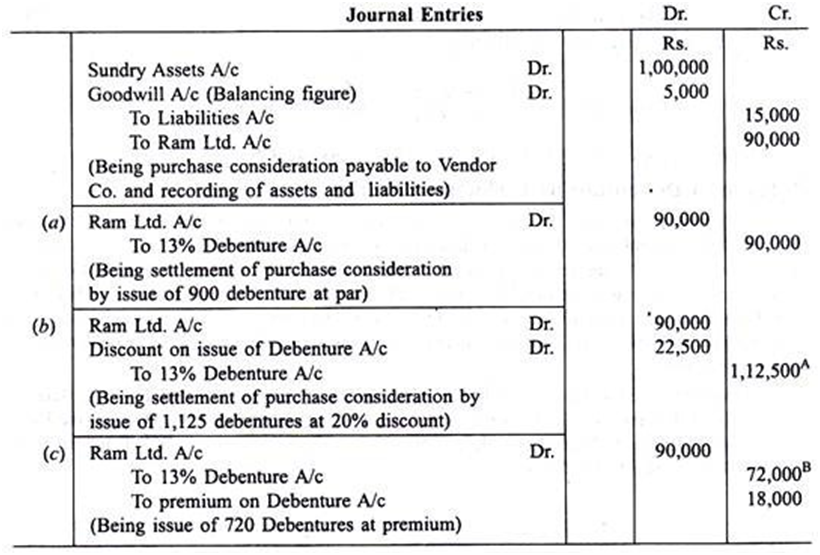

(B) Issue of Debentures for Consideration other than Cash:

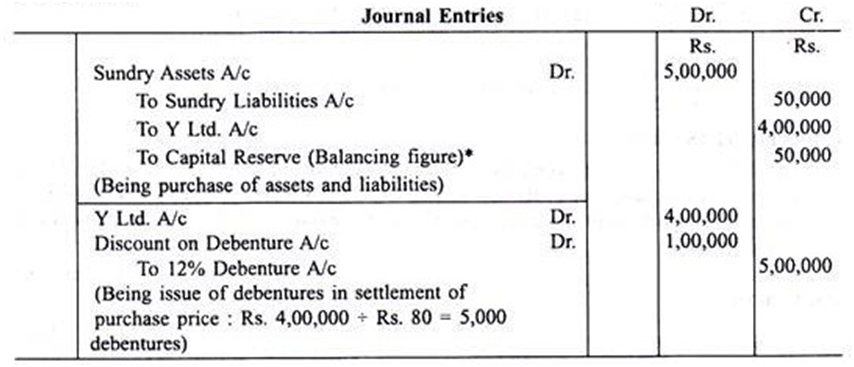

Illustration 4:

X Ltd. acquired assets of Rs. 5,00,000 and took over the liabilities amounted to Rs. 50,000 at an agreed value of Rs. 4,00,000 of Y Ltd., issued 12% Debentures at a discount of 20% in full satisfaction of the purchase price. Show the entries.

Solution:

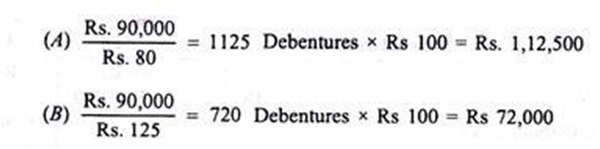

Illustration 5:

Prem Ltd. purchased assets from Ram Ltd. for a book value of Rs 1, 00,000 and liabilities worth Rs. 15,000 for a purchase consideration of Rs. 90,000. The two companies agreed to settle the purchase consideration by the issue of 13% debentures of Rs. 100 each.

Pass necessary journal entries in the books of Prem Ltd assuming that:

(a) Debentures are issued at par.

(b) Debentures are issued at a 20% discount.

(c) Debentures are issued at 25% Premium.

Solution:

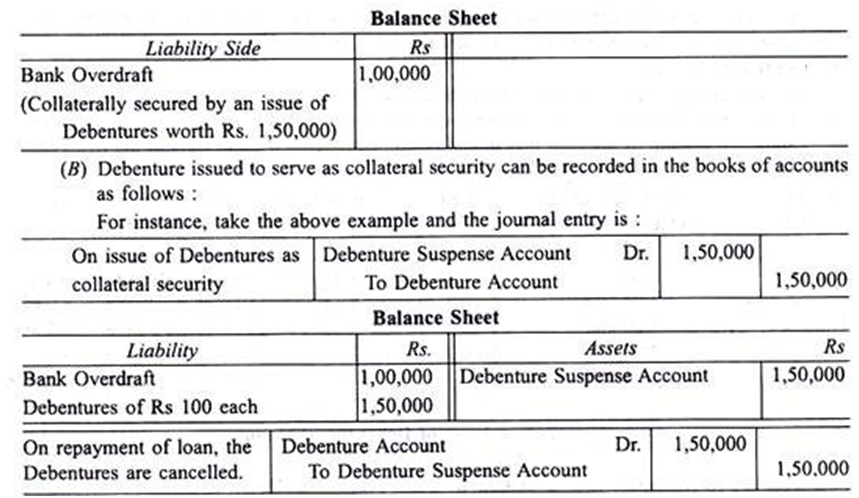

B.. Issue of Debenture as Collateral Security:

A Company can issue debentures to serve as collateral security for a loan or for Bank Overdraft. Collateral security can be realized by its possessor if the original loan is not paid on the due date. Such Debentures are by nature a contingent liability against the issuing Company though they become a definite liability in the event of the breach of the agreement. The holder of such Debenture is not entitled to any interest. On the payment of the concerned loan, such Debenture reverts back to the Company.

There are two ways to deal with such an issue of Debenture in the books of accounts:

(A) No entry need be made in the books of accounts. However, a note is made in the Balance Sheet. For instance, Indian Limited secures an overdraft for Rs 1, 00,000 from the Bank by depositing Debentures worth Rs 1, 50,000 as collateral security.

This will appear in the Balance Sheet as follows:

Discount on Debentures:

The loss on issue of Debentures – Discount on Issue of Debentures or Premium Payable on Redemption – appears in the Balance Sheet. This is because they are losses – treated as Capital Losses. It is a fictitious asset that must be written off as early as possible.

There are two methods by which the loss or discount on the issue of Debenture Account is to be written off:

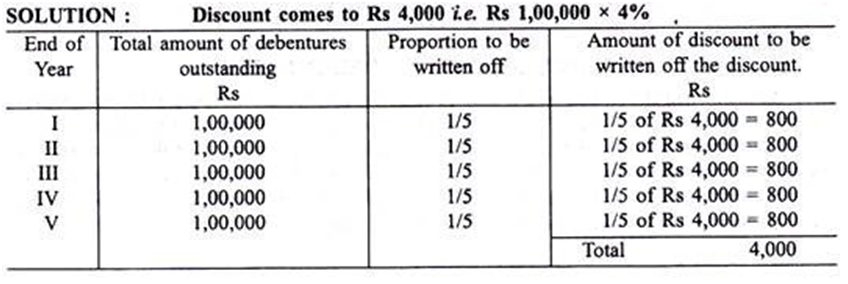

(a) Equal Annual Writing off of Debenture Discount:

When debentures are to be redeemed after a fixed period, say 5 years, then the amount of discount on the issue of debentures can be transferred to Profit and Loss Account by equal installments. For example, a Company issued 1,000 Debentures of Rs 100 each at a discount of Rs 2,000. Then the amount of discount to be transferred to Profit and Loss Account is Rs 400 i.e. 2,000/5.

(b) Writing off the Discount when Debentures are Paid Back by Instalments:

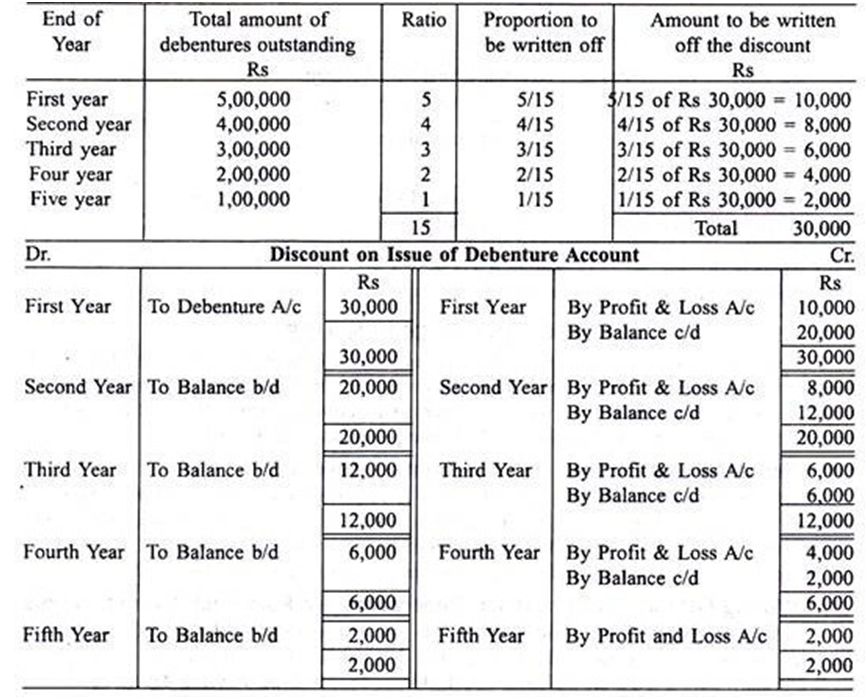

When the debentures are repaid by installments, the amount to be written off each year should be in proportion to the amount outstanding against debentures.

That is, the amount to be debited to Profit and Loss Account on the basis of calculation, based on outstanding debentures:

Illustration 6:

A Company issued Rs 1, 00,000 10% Debentures at 96%. The terms of issue provide the repayment of the debentures at the end of the 5th year. Show the amount of discount that should be written off in each of the five years.

Rs. 800 to be written off against Profit and Loss Account i.e. equal annual installments. This is because each year has the benefit of the whole of the debentures.

Issue of Debentures With Terms of Redemption & Writing off the losses:

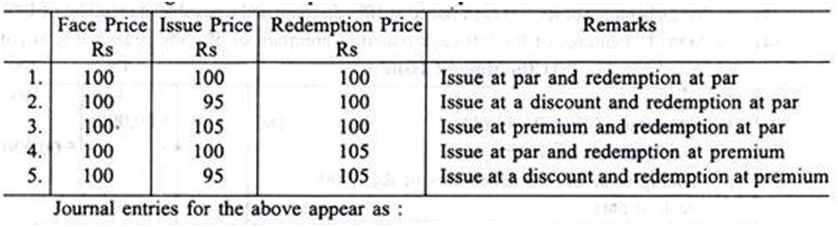

Debentures may be issued at par, at premium or at a discount. Further, the repayment of the Debentures i.e. its redemption may also be at par or at premium. The loss arising on account of the liability of premium payable on redemption is of the same nature as discount allowed at the time of issue.

The loss on account of premium payable on redemption should also be written off over the lifetime of the debenture and should be computed precisely the same way as the provision for writing off the discount. Debentures are issued with certain conditions at which redemption can be made. Conditions of redemption will be coupled with the conditions of issue.

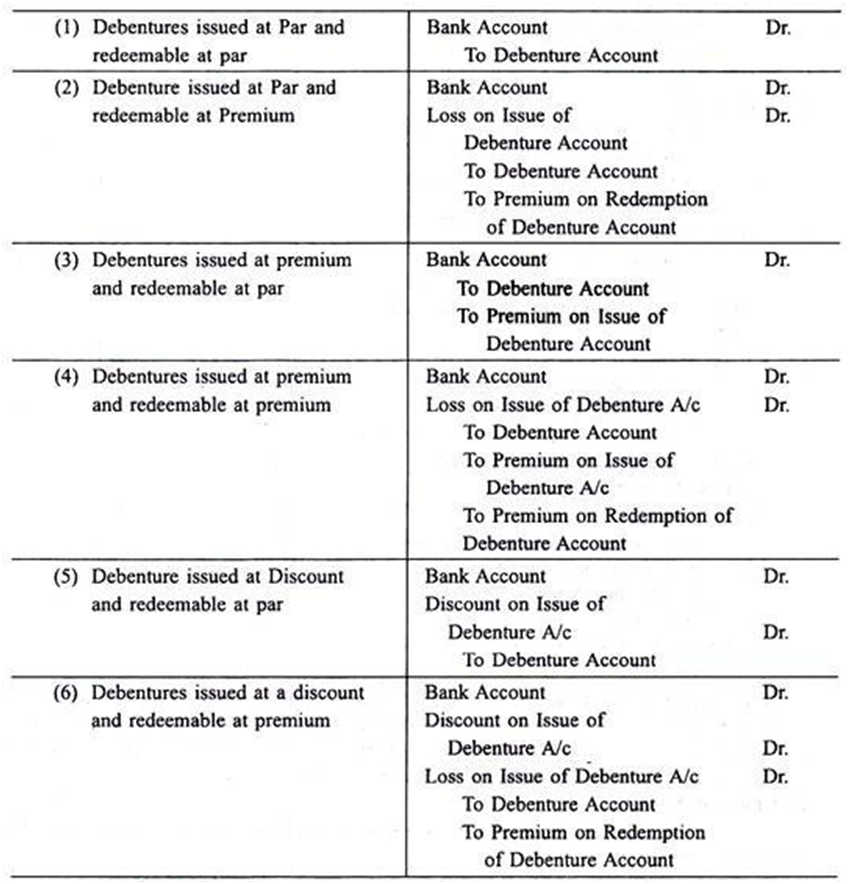

Such terms and their journal entries are given below:

Illustration 7:

A Company issued Rs 5, 00,000 12% Debentures at 94%. The terms of the issue include the repayment of the debentures in five equal installments beginning with the end of the first year of the issue. Show the amount of discount that should be equitably written off in each of the five years.

Solution:

Discount on Debenture represents a loss of capital nature. It may not be possible to write off the entire loss against the Profit and Loss Account in the year in which the discount is allowed. As such the amount of discount is written off gradually over a number of years against Profit and Loss Account i.e. distributable profits. By doing so, the reported profits can be reduced otherwise it would be appropriated for dividends to shareholders and by the way, the cash can also be retained in the business.

Illustration 8:

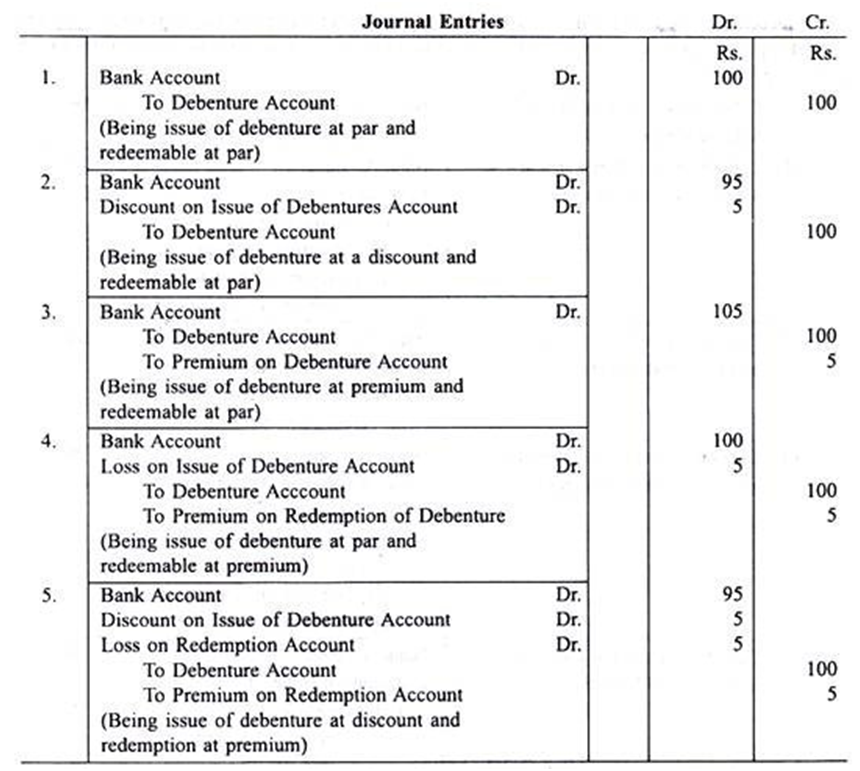

The following illustrations explain the various possibilities:

Discount on Issue of Debenture is a capital loss and should be written off over a number of years against the Profit and Loss Account and in the meantime, it should be shown in the Balance Sheet to the extent not written off. Debentures are credited with the face value at the time of issue and the calculation of interest is always with reference to the face value.

Illustration 9:

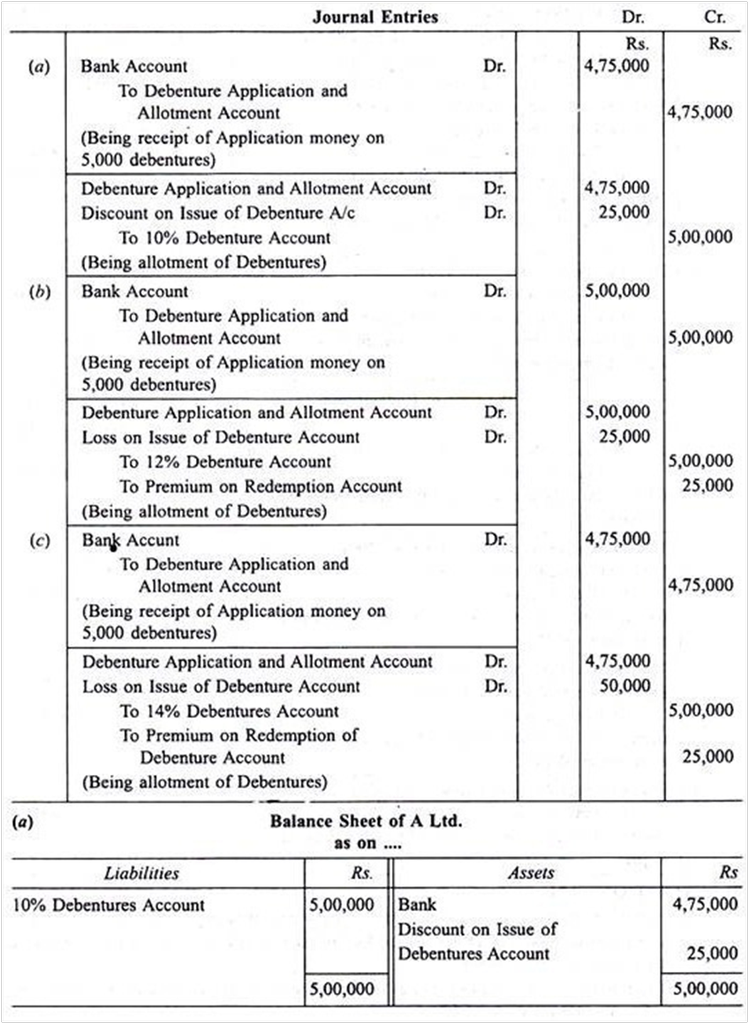

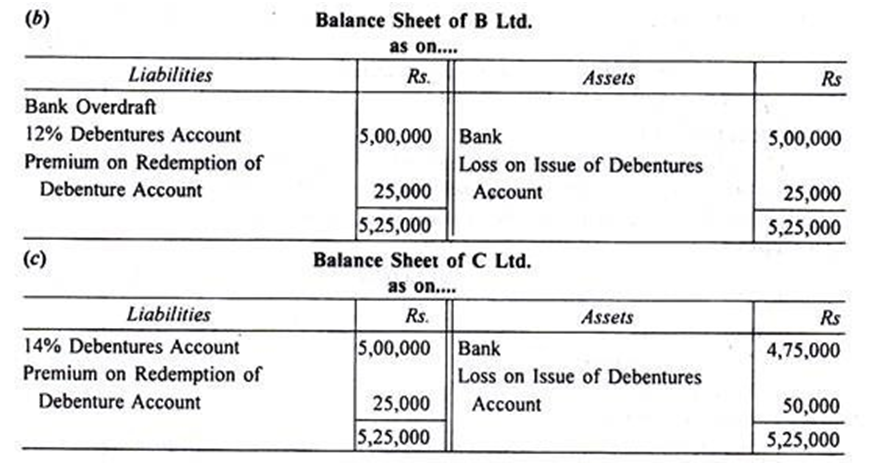

Journalize the following transactions and also show how they appear in Balance Sheets:

(a) A Ltd. issued 5,000 10% Debentures of Rs. 100 each at a discount of 5% and redeemable at the end of 5 years at par.

(b) B Ltd. issued 5,000 12% Debentures of Rs. 100 each at par and redeemable at the end of 5 years at a premium of 5%.

(c) C Ltd. issued 5,000 14% Debentures of Rs. 100 at a discount of 5% and redeemable at the end of 5 years at a premium of 5%.

Solution:

An interest paid is an award to all the debenture holders for investing in the debentures of an enterprise. Usually, interest is paid in a periodical systematic manner at a fixed rate of interest on the face value of the debentures and is being treated as a charge on the profits.

Accounting Treatment for Interest on Debentures :

When interest is due and tax is deducted at source:

Interest on Debentures A/c Dr.

To Debentureholders’ A/c Cr.

To TDS Payable A/c Cr.

(Amount of interest due on debenture and tax deducted at source)

For payment of interest to debenture holders :

Debenture holders A/c Dr.

To Bank A/c Cr.

(Amount of interest paid to debenture holders)

On transfer debenture Interest Account to the statement of Profit and Loss :

Statement of Profit and Loss Dr.

To Interest on Debentures A/c Cr.

(Debenture interest transferred to profit and loss A/c)

On payment of tax deducted at source to the Government :

TDS Payable A/c Dr.

To Bank A/c Cr.

(Payment of tax deducted at source on interest on debentures)

The loss or discount on the issue of debentures is typically a capital loss or a fictitious asset and, hence, has to be written-off during the debentures’ lifetime. The amount of loss or discount on issue of debentures has to be not be written-off during the year of its issue since the benefit of the debentures would accumulate to the enterprise till their restitution or redemption.

The loss or discount is, hence, considered as a capital loss. The discount might be charged to either Securities Premium A/c or might be written-off over three to five years via the statement of Profit and Loss as per guidance circulated by ICAI (The Institute of Chartered Accountants of India).

If there are no capital profits or if the capital profits are insufficient, the amount of such loss or discount can be written-off against the revenue profits each year by passing the below-mentioned journal entry :

Statement of Profit and Loss Dr.

To Discount/Loss on Issue of Debentures A/c

(Discount/loss on issue of debentures written-off)

There are two procedures, which can be accepted for writing off loss or discount on the issue of debentures against the revenue profits. They are as follows :

- Fixed Instalment Method: When the debentures are recovered during the end of a particular period, the amount of the discount must be written off in equivalent installments of fixed amount over that time frame.

- Fluctuating Instalment Method: When debentures are paid back in installments or by annual drawings, the discount must be written off in the ratio of debentures that is outstanding during the closure of each accounting year. The amount of the discount goes on reducing year by year, under this method. Hence, this method is referred to as Reducing Instalment Method.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY