1. Nature of partnership, Partnership Deed, Maintenance of Partnership accounts,

Meaning

Partnership business is an association between two or more persons who agree to do business & share profits & losses. The partners act as both agents & principals of the firm.

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” Section 4 of Indian Partnership Act, 1932.

Nature & Essential features of Partnership

Partnership is a separate business entity from the accounting viewpoint. However, from the legal viewpoint, a partnership firm is not separate from its partners. In case the business assets are not enough to meet the liabilities, the partner’s personal assets would also be liable to meet the debts.

Features

- Two or more persons – In a partnership business, the minimum number of partners is two & the maximum number of partners allowed is 50.

- Agreement – The relationship between partners is based on an agreement & that agreement is known as Partnership Deed.

- Profit-sharing – A partnership business is formed to do lawful business.

- Business of partnership can be carried on by all or any of them acting for all.

Partnership Deed

Partnership comes into existence by an oral or written agreement between the partners which contains all the terms & conditions of partnership. This agreement defines the relationship between partners. It is a legal document which is signed by all the partners. This document helps in avoiding any kind of dispute in future among the partners. This document is known as Partnership Deed.

A partnership deed, we can say, is the most important document in partnership business & it consists of the following clauses;

- Description of partners – Name, description & address of partners.

- Description of the firm – Name & address of the firm.

- Principal place of business – Address of the principal place of business

- Nature of business – What type of business is it - Trading or manufacturing? The nature of business is mentioned here.

- Commencement of Business – Date of commencement of partnership is mentioned here.

- Capital Contribution – The amount of capital to be contributed by each partner & whether the capital accounts are fixed or fluctuating.

- Interest on Capital – Rate of interest, if allowed, on capital

- Interest on Drawings – Rate of interest, if to be charged, on drawings

- Profit-Sharing Ratio – Ratio in which profits & losses are to be shared by partners.

- Interest on Loan – Rate of interest on loan given by a partner to a firm.

- Salary – Amount of salary, and commission to be paid to the partners

- Settlement of accounts – The manner in which the accounts of the partners are to be settled in case of his retirement, death or dissolution of partnership.

- Accounting period – The date on which accounts shall be closed every year.

- Rights & duties of partners – The rights & duties of partners are defined here.

- Duration of partnership – The period of partnership for which it has been started.

- Bank account operation – How shall the bank accounts be operated? Whether it shall be operated by any partner or jointly.

- Valuation of Assets – The manner in which the assets & liabilities of the firm are to be valued.

- Death of a partner – Whether the firm will continue or dissolve after the death of a partner.

- Settlement of Disputes – If there is any dispute among the partners then how it’ll be settled.

SPECIAL ASPECTS OF A PARTNERSHIP ACCOUNT

When the partnership deed is silent or does not have any clause in respect of the following matters or no partnership deed has been prepared by the partners, the following provisions of the Indian Partnership Act, 1932, shall apply:-

- Sharing of profit & losses – Profit & losses to be shared equally by all the partners.

- Interest on Capital – Interest on capital is not paid to any partner.

- Interest on Drawings – Interest on drawings is not charged to any partner.

- Interest on loan or advance/ loans by partners – Interest on loans is paid @ 6% pa. Interest is payable even if there is a loss.

- Remuneration to partners – Remuneration (salary, commission etc.) is not paid or allowed to any partner.

Some other important points:-

- A minor may be admitted for the benefit of partnership.

- A partner may retire from partnership with the consent of other partners or as per the agreement.

- Registration of firm is optional & not compulsory.

- Unless otherwise agreed by the partners, a firm is dissolved on the death of a partner.

Note – These provisions are applicable even if the partnership deed does not have a clause to this effect.

Maintenance of Partnership Accounts

This is how partnership accounts are maintained

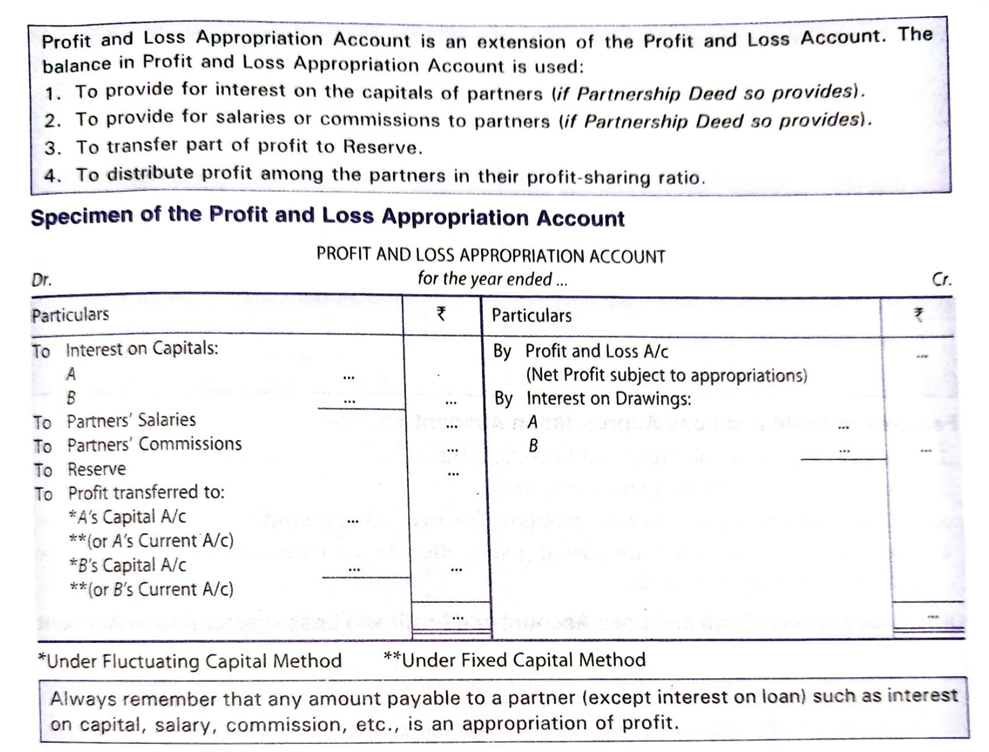

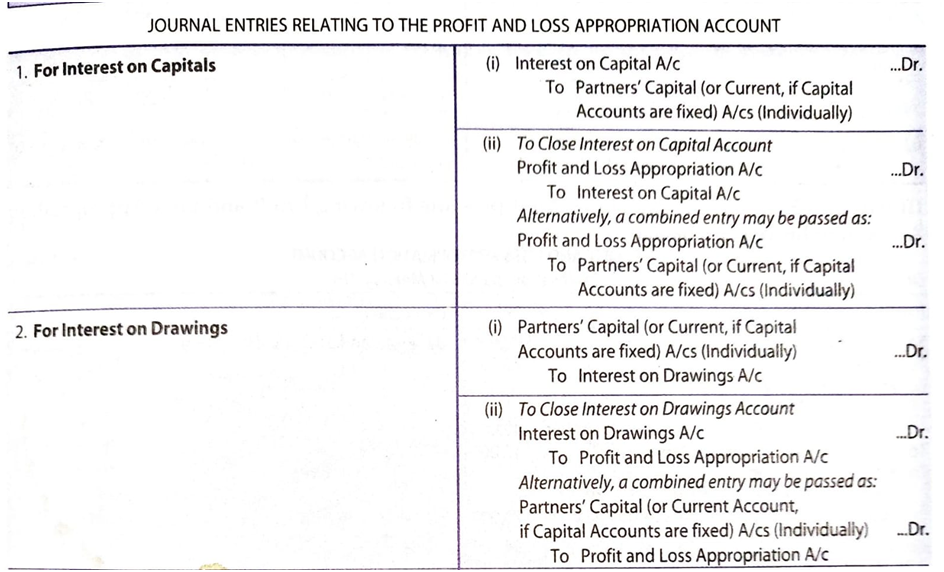

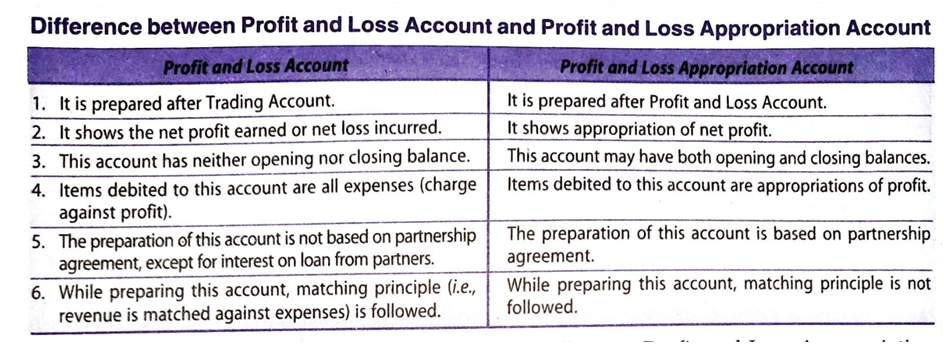

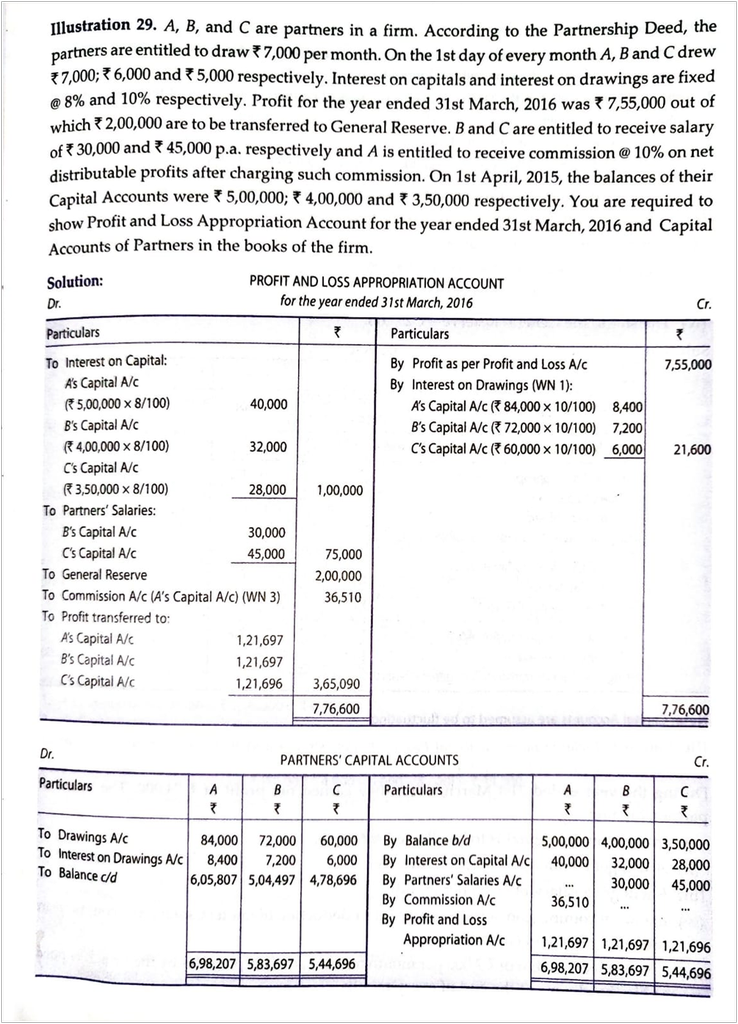

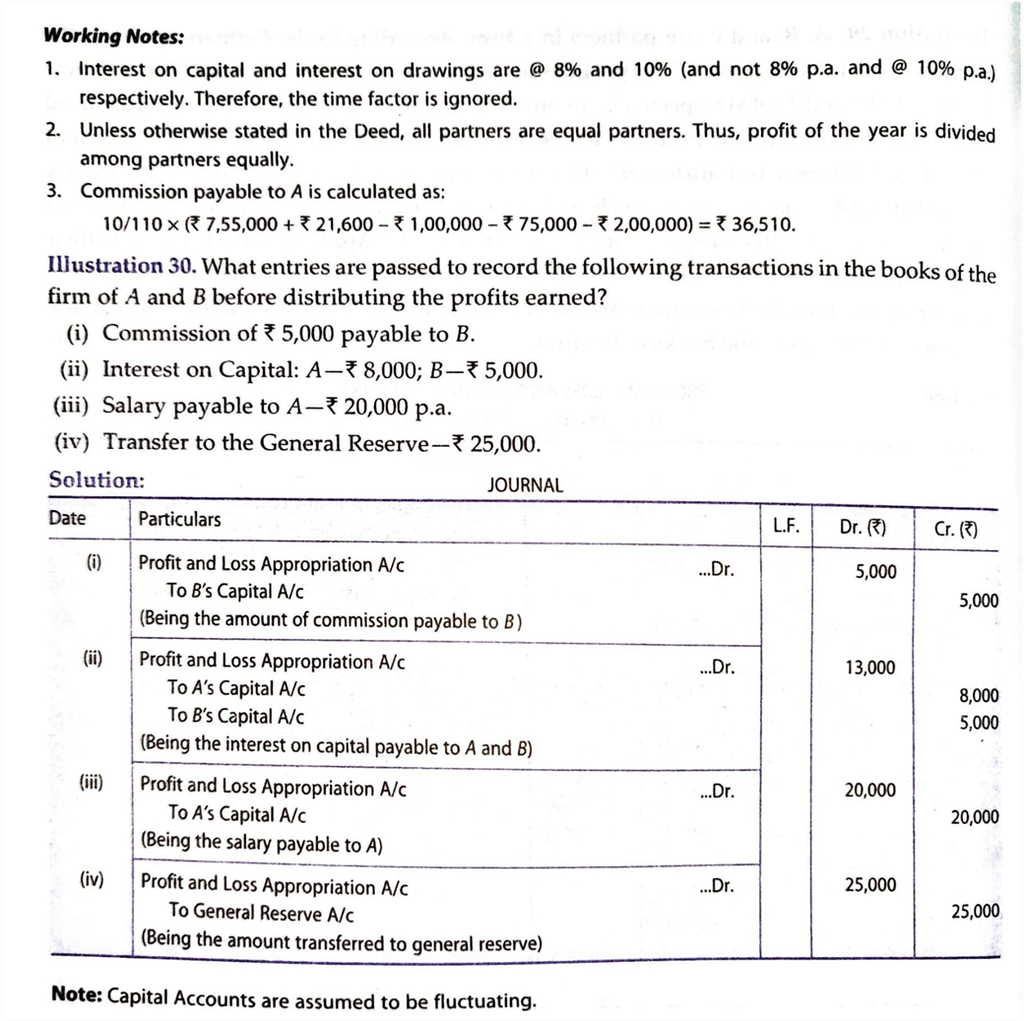

After the determination of net profit by preparing Profit & Loss A/c, we have to prepare Profit & Loss Appropriation A/c. Profit & Loss Appropriation A/c is an extension of Profit & Loss A/c. It is credited with the Net Profit taken from the Profit & Loss A/c & interest on drawings & debited with interest on capital, partner’s salaries & commissions. If the partners decide to transfer a certain part of the profit to Reserves, then it is also shown in the Dr side& the balance profit is distributed among the partners in their profit sharing ratio.

2. Maintenance of capital accounts, Distribution of profit among the partners

MAINTENANCE OF CAPITAL ACCOUNTS& DISTRIBUTION OF PROFITS AMONG THE PARTNERS

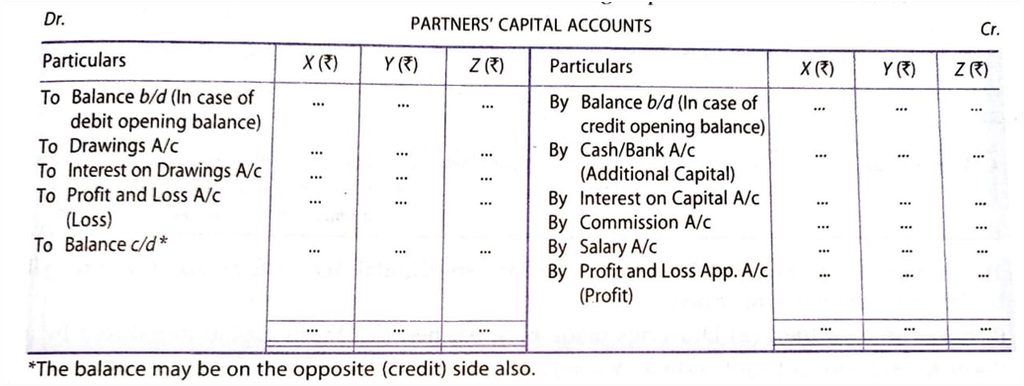

To record the changes in Capital A/c of each partner, we prepare individual capital accounts for each partner. The capital accounts of partners can be maintained in two methods :

Fixed Capital Method

Fluctuating Capital Method

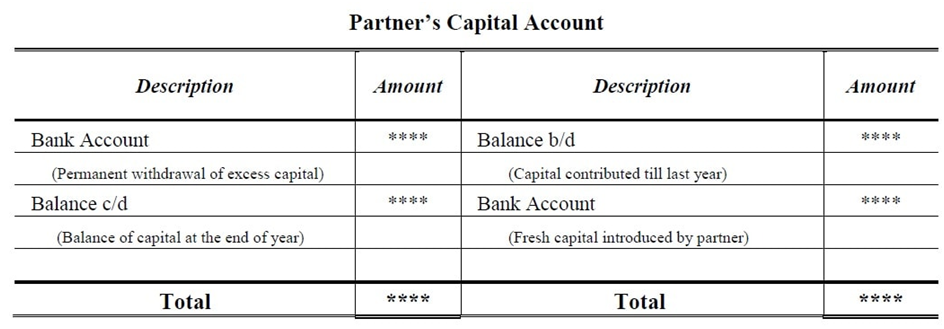

- Fixed Capital Method – In this method, the capital A/c of partners remains unaltered or fixed. When this method is followed, two accounts i.e. Capital A/c & Current A/c for each partner are maintained.

- Capital A/c – The capital account remains unaltered i.e. fixed unless additional capital is introduced or withdrawal is made from the existing capital. If there is no fresh capital introduced or any withdrawals, the capital account of the partner show the same balance year after year.

- Current A/c – It is prepared to record transactions other than introduction & withdrawal of capital such as interest on capital, interest on drawings, salary or commission to a partner, and share of profits/losses. The balance of current account always keeps fluctuating because of these adjustments.

Current A/c is debited with;

- Drawings made by partner

- Interest on drawings

- Share of loss

- Transfer of amount to any capital account permanently

Current A/c is credited with;

- Interest on capital

- Salary or commission

- Share of profits

- Transfer of any amount from capital account permanently

- Fluctuating Capital A/c – Under Fluctuating Capital method, only one account namely Capital A/c is maintained for each partner. All the transactions of a partner like salary, commissions, interest on capital are recorded in this account. As a result of this, the capital a/c fluctuates with every transaction. The debit balance of capital account is shown in the liabilities side & the credit balance is shown in the asset side.

INTEREST ON DRAWNGS

- Drawings refers to the amount withdrawn by the owner in cash or in kind.

- Interest on drawings is charged only when it is mentioned in the partnership deed.

- When it is charged, it is debited to Profit & Loss Appropriation A/c.

- It is either debited to Partner’s Capital A/c or Current A/c depending on whether Fixed Capital or Fluctuating Capital method is being followed

INTEREST ON DRAWINGS : - HOW IT IS CALCULATED?

- The computation of Interest on Drawings depends upon various factors like when the amount is withdrawn & the time period for which it remains withdrawn etc.

- So, the situations can be as follows;

- Fixed amount is withdrawn at the BEGINNING of every Month

If a partner withdraws fixed amount in the beginning of every month, interest is charged on the whole amount for 6 ½ months

Interest on Drawings = Total Drawings X Rate of Interest X 6 ½ 100 12

6 ½ months = Average Period

Average Period Formula = Time left after first drawings + Time left after last drawings 2

- Average period should be used only when the amount of Drawings is uniform & the time interval between the two consecutive drawings is also uniform.

- Fixed amount is withdrawn at the END of every Month.

If a partner withdraws a fixed amount at the end of every month, interest is charged for 5 ½ months.

Interest on Drawings = Total Drawings X Rate of Interest X 5 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every Month

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the BEGINNING of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 7 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the END of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 4 ½ 100 12

- Fixed amount is withdrawn during 6 MONTHS

- At the BEGINNING OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- In the MIDDLE OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3

100 12

- At the END OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- If Unequal amount is withdrawn at DIFFERENT DATES, interest on drawings is calculated on the basis of the Simple Method or Product Method

Interest on Drawings = Total of Product X Rate of Interest x 1 or 1 100 12 365

- When the date of withdrawal IS NOT GIVEN, the interest on drawings is calculated for six months on an average basis.

- When Rate of Interest is given without the word PER ANNUM, interest is charged without considering the time factor

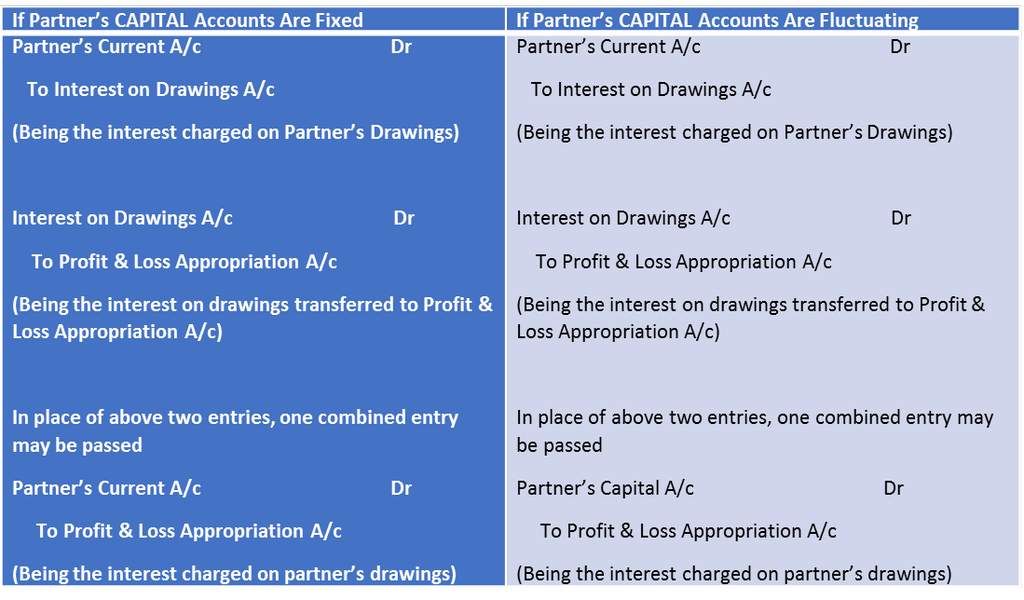

Journal Entries to Record Interest on Drawings

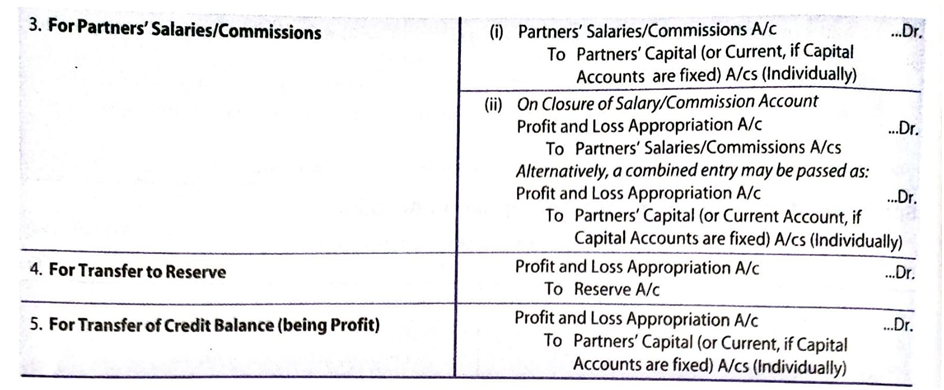

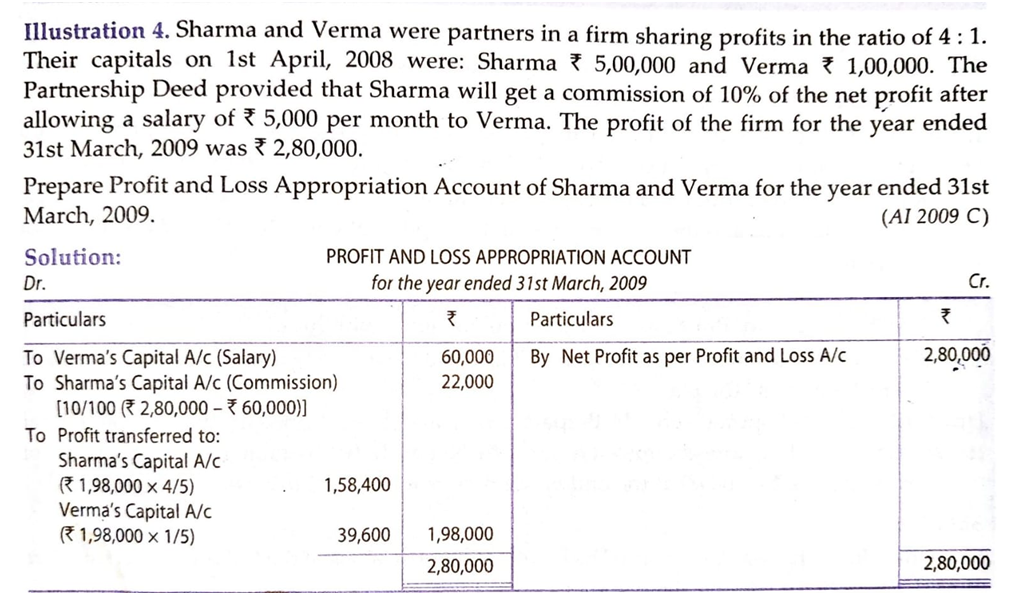

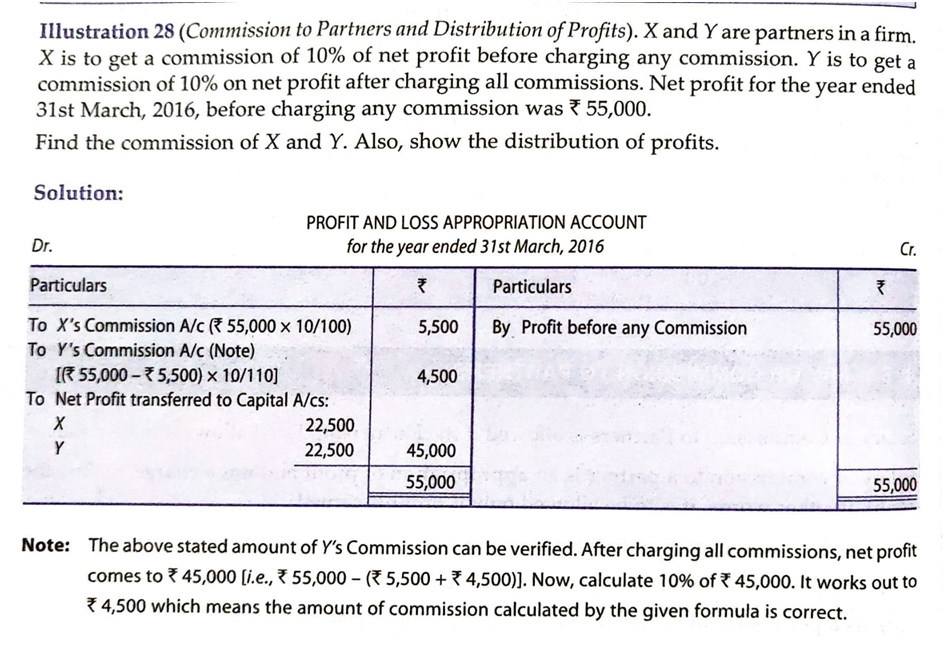

Salary or Commission to Partners

- Salary or commission to partners is paid only when it is allowed in Partnership Deed

- It is an appropriation of profit & not charge against the profit so it should be allowed only when profit is earned

- Commission may be allowed to the partners either

- As a percentage of profit before charging such commission

Net Profit (before Commission) x Rate of commission

100

or

- As a percentage of profit after charging such commission

Net profit (before commission) x Rate of Commission

100+Rate of Commission

Accounting Treatment:-

Partner’s Salaries/ Commission A/c Dr

To Partner’s Current A/c (When capitals are fixed)

To Partner’s Capital A/c (When capitals are fluctuating)

Profit & Loss Appropriation A/c Dr

To Partner’s salaries/commission A/c

Interest on Partner’s Loan to the Firm

- If a partner apart from investing share capital, advances any loan to the firm then he is entitled to receive interest even in the absence of an agreement/deed.

- In the absence of an agreement/deed, the minimum rate of interest on loan to be paid to the partner is 6% p.a.

- Interest on loan is a charge against profit & it is transferred to the debit of Profit/Loss A/c & not to the debit of Profit/Loss Appropriation A/c

- Journal Entries

- Interest on partner’s loan A/c Dr

To Partner’s Loan A/c

- Profit & Loss A/c Dr

To Interest on partner’s loan A/c

3. Guarantee of profit to a partner, Past adjustments, Final accounts

Guarantee of Profit

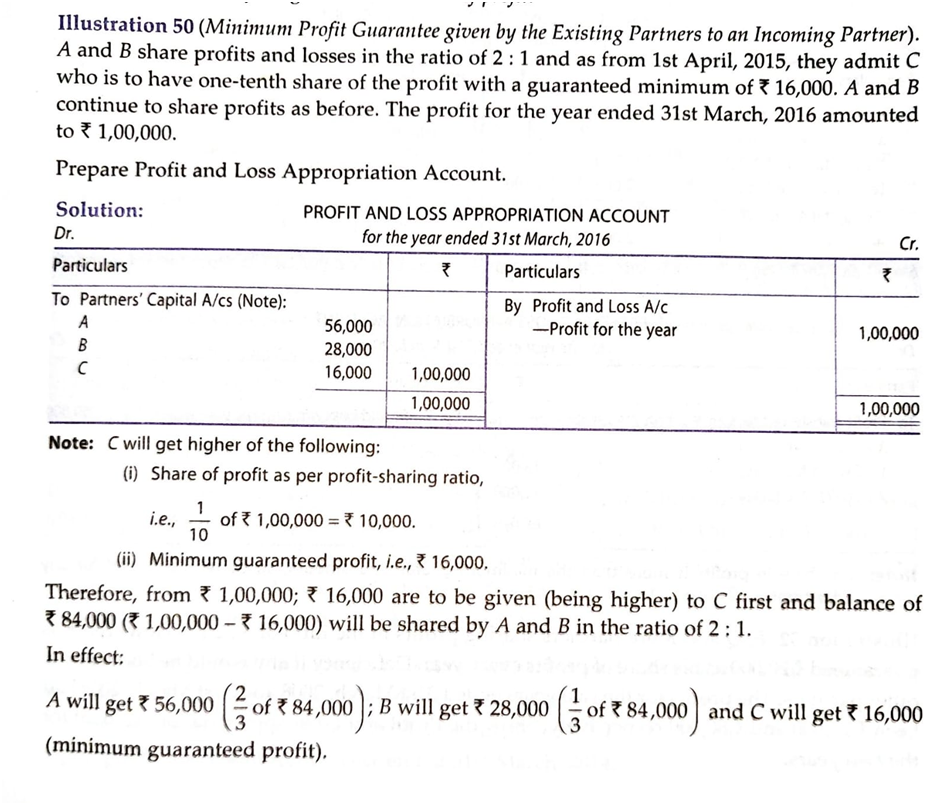

- In some cases, a partner may be admitted in the firm on a guarantee in respect of his minimum profit from the business.

- Such a guarantee may be given to an existing partner as well.

- Such a guarantee to the incoming partner is given ;

- All the old partners in agreed ratio

- Some of the old partners

When all the partners guarantee that one of the partners shall be given a minimum amount of profit, the following amounts have to be calculated separately

- Share of profit as per profit sharing ratio

- Minimum Guaranteed Profit

- The minimum of the above two is given to that partner & the balance of profit (i.e. total profit – profit given to the guaranteed partner) is shared by the remaining partners in the profit-sharing ratio.

- If the partner’s actual share of profit turns out to be more than the guaranteed profit then in that case the partner will be given the actual amount instead of the guaranteed amount.

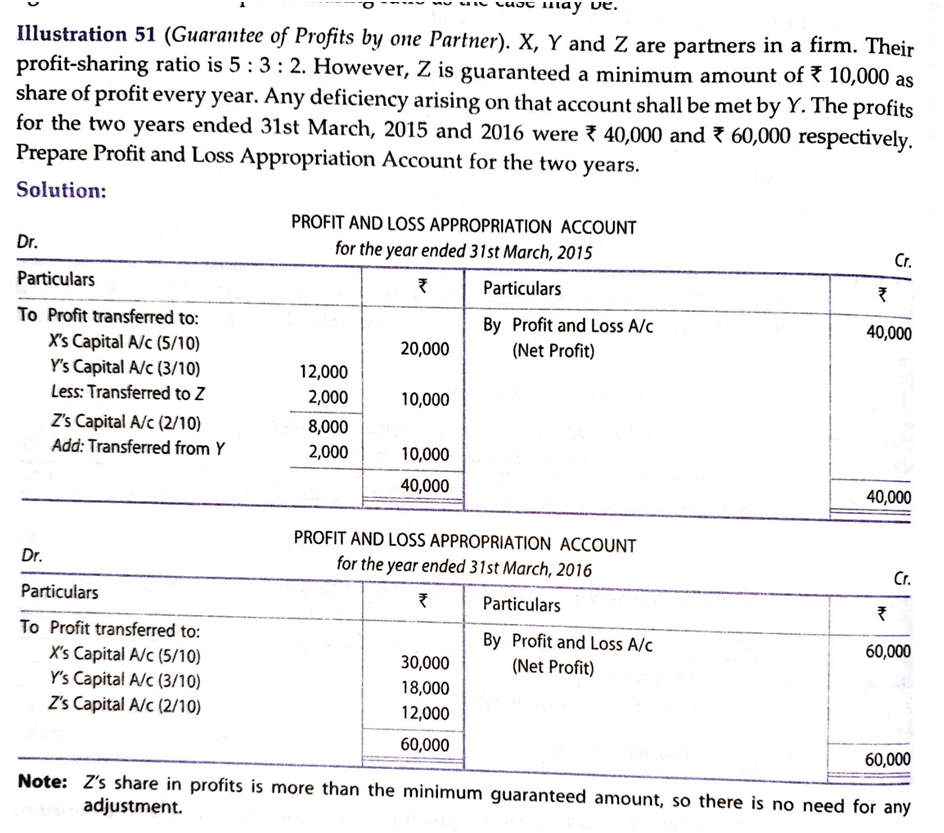

- When one or more than one partner guarantees a minimum profit, the adjustment is made through the partner’s capital accounts. The following steps are followed;

- Distribute the profit among the partners in their profit sharing ratio

- If the share of the guaranteed profit of the partner falls short of the minimum amount then the difference is deducted from the original share of profit of the partners who guarantee & it is added with the original share of profit of the guaranteed partner.

- When two or more partners give guarantee, the shortfall is shared by them in the agreed ratio or in their profit-sharing ration as the case may be.

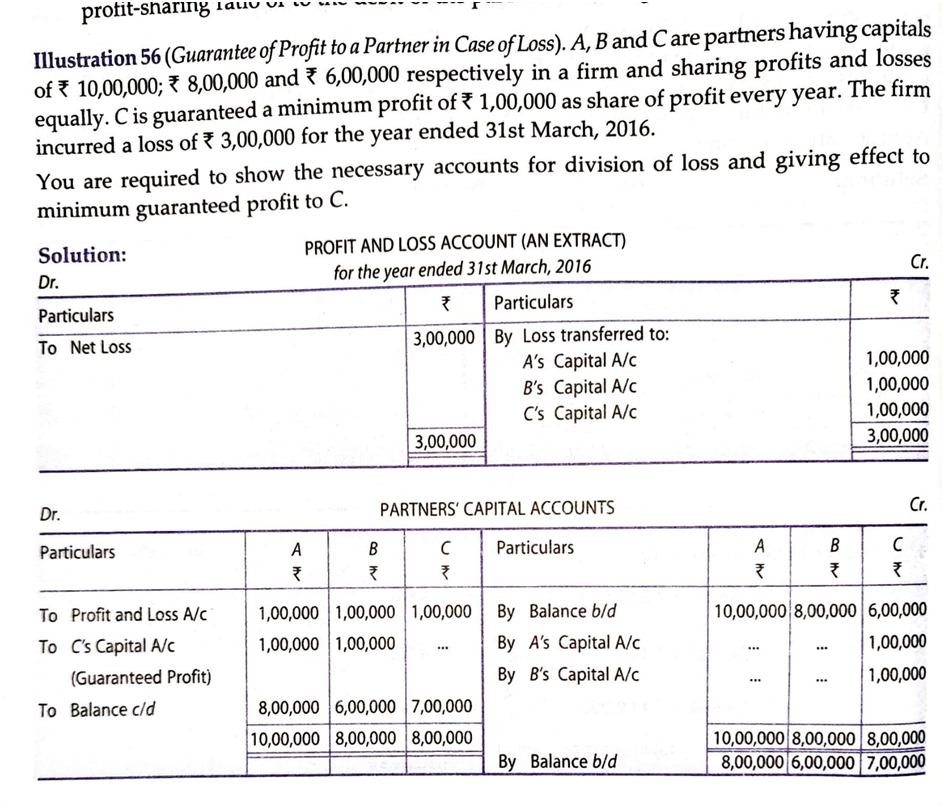

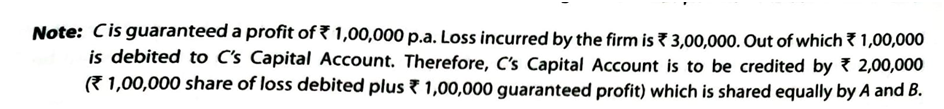

- Accounting Treatment of Guarantee of Profit in case of Loss

- Sometimes it is possible that the firm has incurred losses but the guaranteed profit is to be paid to the partner who has been guaranteed minimum profit. In such a case, the adjustment has to be made through partner’s capital A/c in the following manner;

- Distribute the loss among the partners in their profit sharing ratio

- Capital A/c of the guaranteed partner is credited with guaranteed minimum profit plus the amount of loss. This amount is debited to remaining partners in their profit sharing ratio or to the debit of the partner who has guaranteed minimum profit.

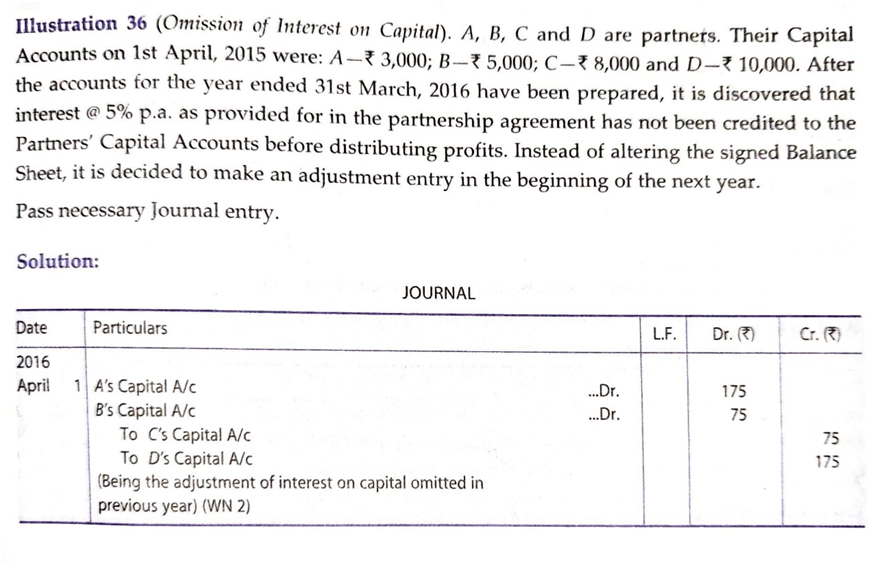

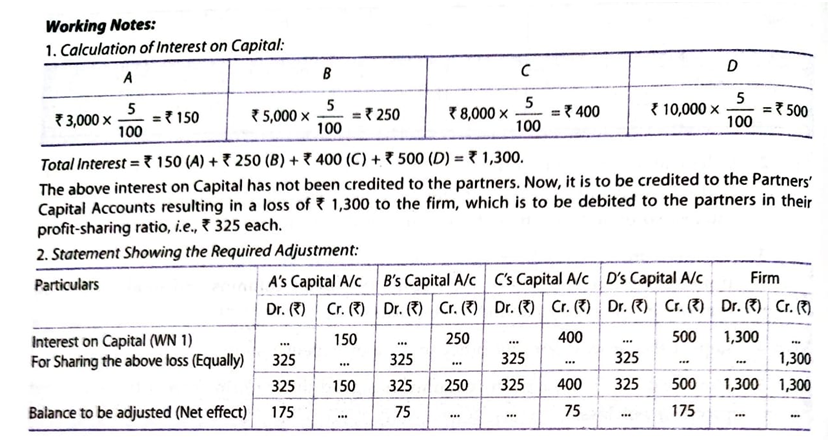

Past Adjustments

Sometimes, after the final accounts of a firm have been closed, it is found that certain matters have been left out by mistake. In such cases, instead of altering the final accounts which have already been closed, the firm rectifies the error or omission by passing an adjustment entry in the beginning of the financial year. Such adjustments are called past adjustments as they relate to the past.

Steps to pass adjusting journal entry:

Step 1 Calculate the amount already recorded.

Step 2 Calculate the amount which should have been recorded.

Step 3 Calculate the difference between Step 1 and Step 2.

Step 4 Find out the partner who received excess and the partner who received short.

Step 5 Pass the adjusting journal entry by debiting the partner who received excess and by crediting the partner who received short.

PREPARATION OF FINAL ACCOUNTS OF PARTNERSHIP FIRM

Final accounts of a partnership firm are prepared in the usual way in which they are prepared for a sole proprietorship concern except that the profits in the partnership have to be distributed among the various partners according to the terms of the partnership contract and the amount of profit may be arrived at after making adjustments for interest on capital, interest on drawings, salaries to partners, etc. for this another account “Profit & Loss Appropriation Account” is prepared after preparing Profit & Loss Account.

The final accounts prepared by partnership firms are:

a) Manufacturing account – if manufacturing activity is carried on

b) Trading and profit and loss account – to ascertain profitability

c) Profit and loss appropriation account – to show the disposal of profits and surplus

d) Balance sheet – to ascertain the financial status.

Vision classes

Vision classes