Meaning

Partnership business is an association between two or more persons who agree to do business & share profits & losses. The partners act as both agents & principals of the firm.

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” Section 4 of Indian Partnership Act, 1932.

Nature & Essential features of Partnership

Partnership is a separate business entity from the accounting viewpoint. However, from the legal viewpoint, a partnership firm is not separate from its partners. In case the business assets are not enough to meet the liabilities, the partner’s personal assets would also be liable to meet the debts.

Features

- Two or more persons – In a partnership business, the minimum number of partners is two & the maximum number of partners allowed is 50.

- Agreement – The relationship between partners is based on an agreement & that agreement is known as Partnership Deed.

- Profit-sharing – A partnership business is formed to do lawful business.

- Business of partnership can be carried on by all or any of them acting for all.

Partnership Deed

Partnership comes into existence by an oral or written agreement between the partners which contains all the terms & conditions of partnership. This agreement defines the relationship between partners. It is a legal document which is signed by all the partners. This document helps in avoiding any kind of dispute in future among the partners. This document is known as Partnership Deed.

A partnership deed, we can say, is the most important document in partnership business & it consists of the following clauses;

- Description of partners – Name, description & address of partners.

- Description of the firm – Name & address of the firm.

- Principal place of business – Address of the principal place of business

- Nature of business – What type of business is it - Trading or manufacturing? The nature of business is mentioned here.

- Commencement of Business – Date of commencement of partnership is mentioned here.

- Capital Contribution – The amount of capital to be contributed by each partner & whether the capital accounts are fixed or fluctuating.

- Interest on Capital – Rate of interest, if allowed, on capital

- Interest on Drawings – Rate of interest, if to be charged, on drawings

- Profit-Sharing Ratio – Ratio in which profits & losses are to be shared by partners.

- Interest on Loan – Rate of interest on loan given by a partner to a firm.

- Salary – Amount of salary, and commission to be paid to the partners

- Settlement of accounts – The manner in which the accounts of the partners are to be settled in case of his retirement, death or dissolution of partnership.

- Accounting period – The date on which accounts shall be closed every year.

- Rights & duties of partners – The rights & duties of partners are defined here.

- Duration of partnership – The period of partnership for which it has been started.

- Bank account operation – How shall the bank accounts be operated? Whether it shall be operated by any partner or jointly.

- Valuation of Assets – The manner in which the assets & liabilities of the firm are to be valued.

- Death of a partner – Whether the firm will continue or dissolve after the death of a partner.

- Settlement of Disputes – If there is any dispute among the partners then how it’ll be settled.

SPECIAL ASPECTS OF A PARTNERSHIP ACCOUNT

When the partnership deed is silent or does not have any clause in respect of the following matters or no partnership deed has been prepared by the partners, the following provisions of the Indian Partnership Act, 1932, shall apply:-

- Sharing of profit & losses – Profit & losses to be shared equally by all the partners.

- Interest on Capital – Interest on capital is not paid to any partner.

- Interest on Drawings – Interest on drawings is not charged to any partner.

- Interest on loan or advance/ loans by partners – Interest on loans is paid @ 6% pa. Interest is payable even if there is a loss.

- Remuneration to partners – Remuneration (salary, commission etc.) is not paid or allowed to any partner.

Some other important points:-

- A minor may be admitted for the benefit of partnership.

- A partner may retire from partnership with the consent of other partners or as per the agreement.

- Registration of firm is optional & not compulsory.

- Unless otherwise agreed by the partners, a firm is dissolved on the death of a partner.

Note – These provisions are applicable even if the partnership deed does not have a clause to this effect.

Maintenance of Partnership Accounts

This is how partnership accounts are maintained

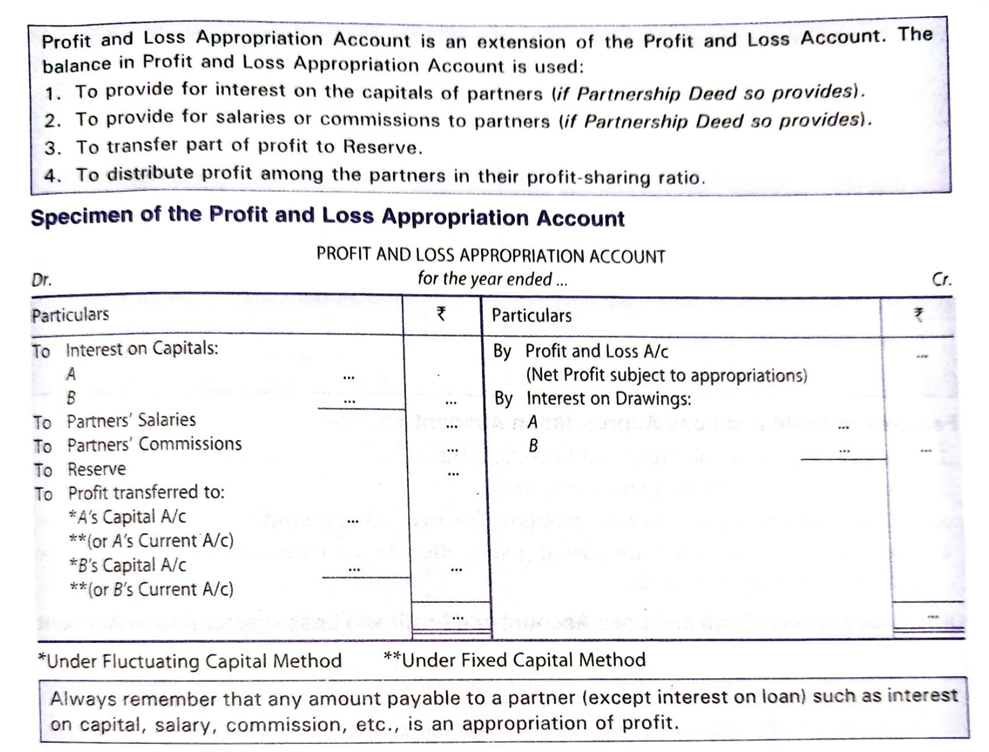

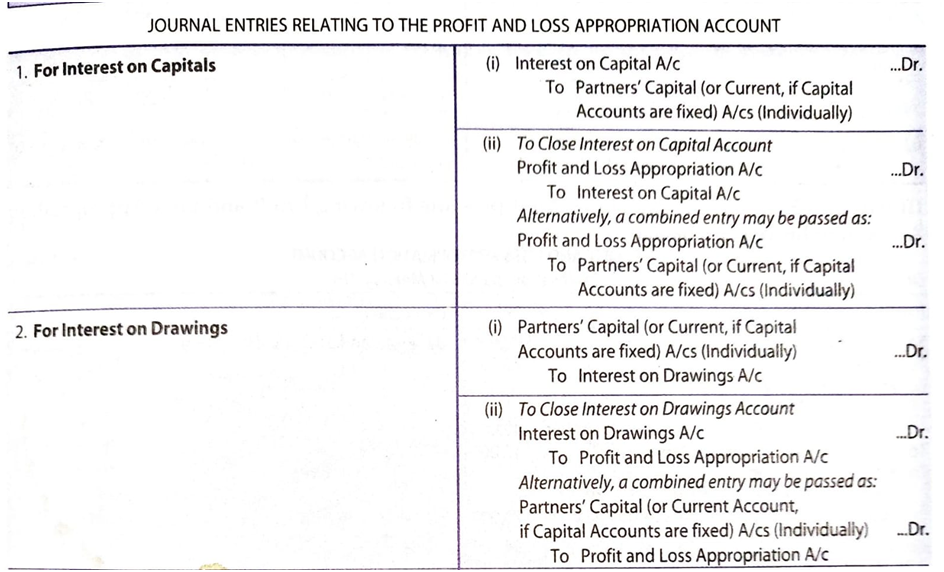

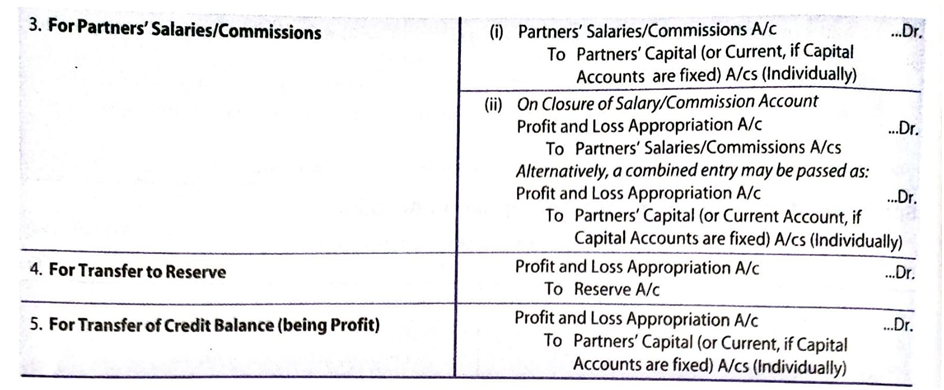

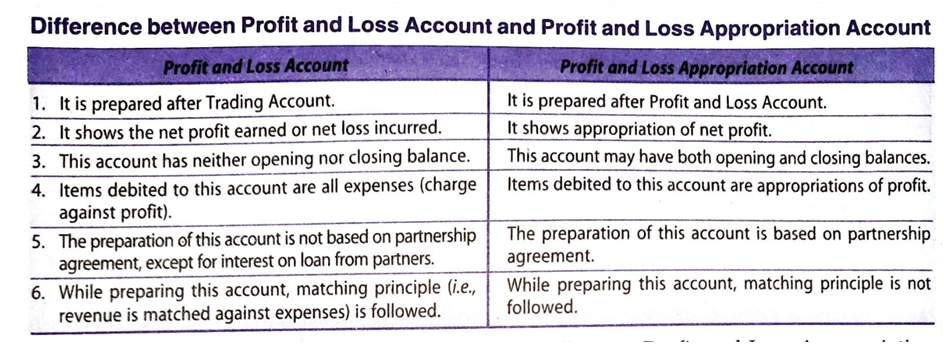

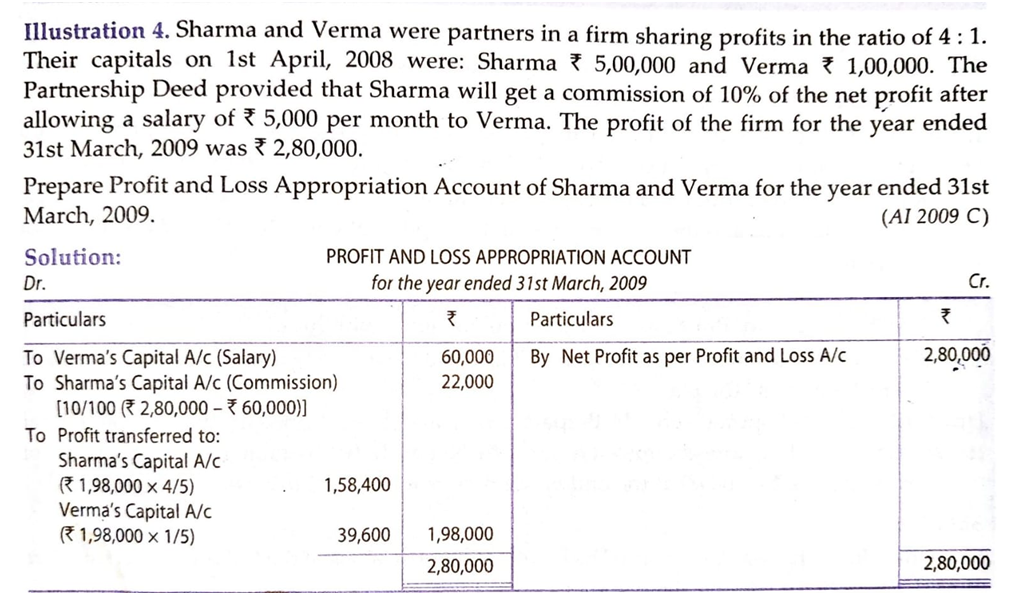

After the determination of net profit by preparing Profit & Loss A/c, we have to prepare Profit & Loss Appropriation A/c. Profit & Loss Appropriation A/c is an extension of Profit & Loss A/c. It is credited with the Net Profit taken from the Profit & Loss A/c & interest on drawings & debited with interest on capital, partner’s salaries & commissions. If the partners decide to transfer a certain part of the profit to Reserves, then it is also shown in the Dr side& the balance profit is distributed among the partners in their profit sharing ratio.

Vision classes

Vision classes