FORFEITURE OF SHARES :

Forfeiture means cancellation of share capital and membership of the shareholder of a company due to non-payment of premium or dues on allotment and/or calls. If some of the shareholders fail to pay their dues on the allotment and/or calls, the Board of Directors may forfeit such shares according to the provisions of the Articles of Association by passing a resolution to that effect.

Causes of Forfeiture: The shares may be forfeited due to :

(i) Non-payment of the allotment money.

(ii) Non-payment of the call money.

(iii) Non-payment of premium in case of issue of shares at a premium.

(iv) Non-payment of any other amount due from the shareholder.

Effects of forfeiture: When the shares are forfeited, it results in the following :

(i) The holder of the shares ceases to be a member/shareholder of the company.

(ii) The amount paid to date is not refunded to the shareholder. It becomes the property of the company.

(iii) The share capital account is canceled to the extent called up to date.

(iv) The amount so forfeited is kept in a separate account called “Forfeited Share.

Account”. This account is added to the share capital account in the Balance Sheet.

(v) The share premium account is debited to the extent unpaid in case forfeited shares were issued at a premium.

(vi) The discount, if any, allowed at the time of issue is also canceled to the extent of shares forfeited by crediting to Discount on Issue of Shares A/c.

JOURNAL ENTRIES

(a) If the unpaid amount has not been transferred to the calls-in-arrear account.

Share Capital A/c Dr.

(i.e. No of shares forfeited × called up value per share)

Share Premium A/c Dr.

(Unpaid premium on forfeited shares)

To Share allotment A/c. (Unpaid amount on allotment)

To Share First Call A/c. (Unpaid amount on 1st call)

To Share Final Call A/c. (Unpaid amount on final call)

To Discount on Issue of Shares A/c.

(Discount originally allowed on the issue of shares)

To Forfeited Shares A/c. (Amount received)

(Being the forfeiture of......Shares for non-payment of allotment/calls/premium as per Director’s Resolution No......dated......)

(b) If the unpaid amount has been transferred to the calls-in-arrear account.

Share Capital A/c. Dr.

(No. of shares forfeited × called-up value per share)

Share Premium A/c. Dr.

(Unpaid premium, if any)

To Call-in-Arrear A/c. (Total amount unpaid)

To Discount on Issue of Shares A/c. (Discount allowed if any)

To Forfeited Shares A/c. (Amount received)

(Being forfeiture of.....shares for non-payment of dues as per Director’s Resolution No.... date......)

RE-ISSUE OF FORFEITED SHARES :

As we know that on forfeiture, the share capital is canceled and the defaulter ceases to be a member/shareholder of the company. It means such forfeited shares can be offered to a new shareholder at a new price. It is called the re-issue of forfeited shares.

The company can re-issue these forfeited shares at any price, i.e. at par, at a premium, or at a discount. But they are usually offered at a discount.

If forfeited shares are re-issued at a discount, then the company has to fulfill a condition. The condition is that the discount allowed at the time of re-issue cannot exceed the forfeited amount. In other words, the discount on re-issue must be less than the amount forfeited.

In case a part of the total shares forfeited is re-issued, then this condition must be satisfied for that part of shares re-issued.

For example, A company forfeited 300 shares of Rs.10 each, Rs.7 called up and the forfeited amount was Rs.600 (i.e. Rs.2 per share). It means the company can re-issue these shares at a maximum discount of Rs.2 per share i.e. at Rs.5 per share. The discount allowed on the re-issue of these shares cannot be more than Rs.600. If the company re-issued a part, say 100 shares, at a discount, then the discount on re-issue cannot be more than Rs.200 (i.e. 1/3 of Rs.600).

PROFIT ON RE-ISSUE:

If the discount on the re-issue of forfeited shares is less than the amount forfeited, then there is a profit. This profit is in the nature of capital profit. Hence, it is transferred to the “Capital Reserve Account”. The Capital Reserve Account is shown under the head“Reserves and Surplus” on the Liabilities side of the Balance Sheet.

For example: If 300 shares were re-issued at a discount of Rs.1.50 per share. The share forfeited account shows a balance of Rs.600. Then the capital profit of Rs.150 [i.e. Rs.600 – (300 shares × Rs.1.50)] is to be transferred to Capital Reserve Account.

The entry will be :

Forfeited shares A/c. Dr.

To Capital Reserve A/c.

(Being the profit on re-issue transferred to capital reserve)

So we have the following four alternatives for the re-issue of forfeited shares.

JOURNAL :

1. On Re-issue :

(a) If forfeited shares were re-issued at par.

Bank A/c. Dr.

To share capital A/c.

(Being the re-issue of....shares @Rs....each as per Director’s Resolution No.....dated.....)

(b) If forfeited shares are re-issued at a premium.

Bank A/c. Dr. .......)

To Share Capital A/c.

To Share Premium A/c.

(Being the re-issue of.......shares @ Rs......each as per Director’s Resolution No.....dated

(c) If forfeited shares are re-issued at a discount.

Bank A/c. Dr. (Actual amount received)

Forfeited Shares A/c. Dr. (Discount on re-issue)

To Share Capital A/c.

(Being the re-issue of.....shares @ Rs....... each as per Director’s Resolution No.......dated)

(d) If shares originally issued at a discount are re-issued at a discount also :

Bank A/c. Dr.

Discount on Issue of Shares A/c. Dr. (Original Discount)

Forfeited Shares A/c. Dr. (Discount on re-issue)

To Share Capital A/c.

(Being the re-issue of......shares of Rs.........each @Rs......each as per Director’s Resolution No.....dated......)

Note: Where a part of the forfeited shares are re-issued, the capital profit to be transferred to capital reserve may be calculated as Capital Reserve = (Forfeited amount per share – Discount on re-issue per share) × No. of shares re-issued.

FORFEITURE AND RE-ISSUE IN CASE OF PRO-RATA ALLOTMENT :

In such a case, it is essential to know the amount paid and not paid for recording the forfeiture of shares. In the case of categorized allotment and pro-rata allotment, it is, therefore, necessary to determine the number of shares applied by the defaulting shareholder on the basis of which the amount paid and not paid can be calculated. It means the excess amount adjusted at a particular stage of the issue can help to determine the net amount not paid at that stage.

D. ISSUE OF SHARES FOR CONSIDERATION OTHER THAN CASH :

Sometimes, a company can issue shares to buy various assets such as land, building, machinery etc. needed at the time of formation.

Sometimes, it may be necessary to issue shares to the promoters, lawyers, etc. for their services rendered in the formation of the company.

The consideration for such shares is not cash but it is other than cash i.e. assets or services. When such shares are issued, those are shown separately under the head “Issued Capital” on the liabilities side of the Balance Sheet with prior information to the Registrar of Companies.

(a) Where the shares are issued for the purchase of Assets

Assets A/c. Dr.

To Share Capital A/c.

(Being an issue of.....shares @Rs......each in exchange of assets purchased as per Director’s Resolution No......dated......)

(b) Where the Shares are issued to promoters

Goodwill A/c.

To share Capital A/c.

(Being an issue of......shares of Rs.......each to promoters as per agreement as per Director Resolution No.....dated.......)

SUMMARY OF JOURNAL ENTRIES

1. For application money received

Bank A/c. Dr.

To Share Application A/c.

2. For the transfer of application money

Share Application A/c. Dr.

To Share Capital A/c.

To Share Allotment A/c.

To Calls-in-advance A/c.

To Bank A/c.

3. For allotment money due

Share Allotment A/c. Dr.

Discount on Issue of Shares A/c. Dr.

To Share Capital A/c.

To Share Premium A/c.

4. For allotment money received

Bank A/c. Dr.

To Share Allotment A/c.

5. For call money due

Share Call A/c. Dr.

To Share Capital A/c.

6. For adjustment of calls-in-advance

Calls-in-advance A/c. Dr.

To Share Call A/c.

7. For call money received

Bank A/c. Dr.

To Share Call A/c.

8. For the amount not received on allotment and calls

Calls-in-arrear A/c. Dr

To Share Allotment A/c.

To Share Call A/c.

9. For the Calls-in-arrear received

Bank A/c. Dr.

To Calls-in-Arrear A/c.

10. For interest received on Calls-in arrear

Bank A/c. Dr.

To Interest on Calls-in-arrear A/c.

11. For Interest paid on Calls-in-Advance

Interest on Calls-in-Advance A/c. Dr.

To Bank A/c

12. For the shares forfeited

Share capital A/c. Dr.

Share Premium A/c. Dr.

To Share Allotment A/c.

To Share Call A/c.

To Discount on Issue of Shares A/c

To Forfeited Shares A/c.

13. For the re-issue of forfeited shares

Bank A/c. Dr.

Discount on Issue of Shares A/c. Dr.

Forfeited Shares A/c. Dr.

To Share Capital A/c.

To Share Premium A/c.

PREPARATION OF CASHBOOK :

In case of issue share for cash, all transactions are made through the bank. Hence, a cash book will be prepared taking bank columns only. It is debited with cash received at various stages of the issue and credited with the payment of cash in case of a refund. It is balanced to find out the net cash received from the issue of shares which is shown on the asset side of the Balance Sheet.

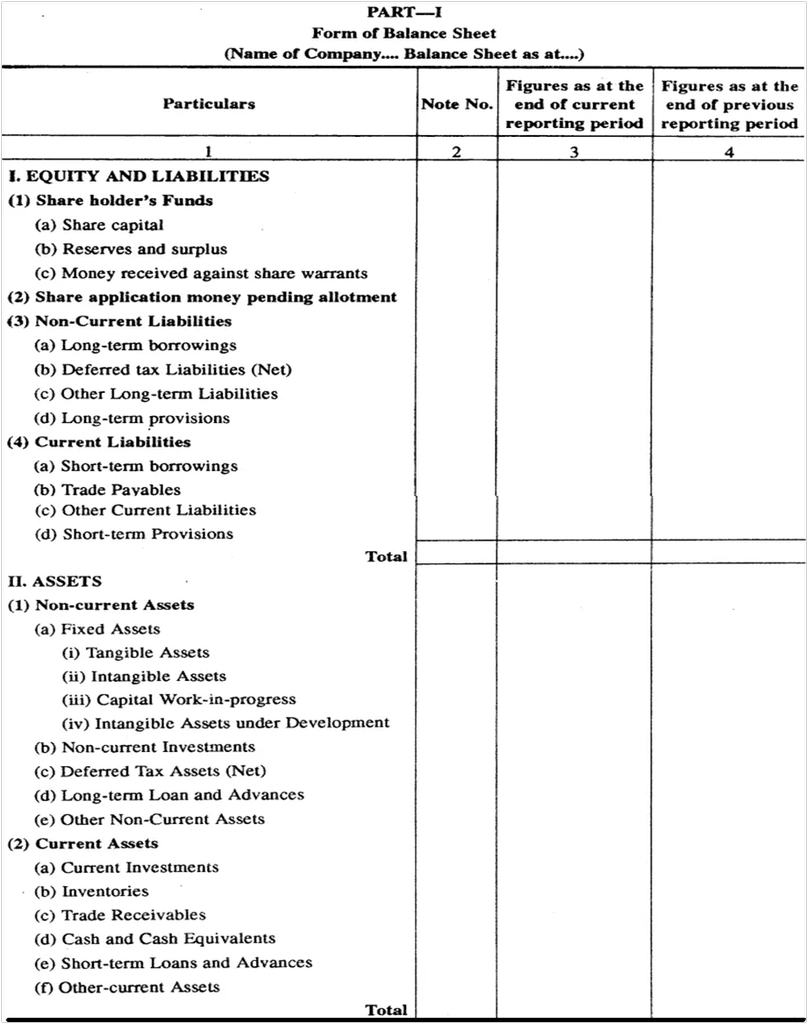

PRESENTATION IN THE BALANCE SHEET :

While preparing the Balance Sheet, the various components of the capital such as authorized capital, issued capital, subscribed capital, etc. are shown on the liabilities side of the Balance sheet under the head ‘share capital’ describing the number of shares and their amounts under each category. The balance of the share capital account in the ledger is put under the head “paid-up share capital” after deducting the amount of calls-in-arrear from subscribed capital. The amount of bank balance (in cash book) is shown under the head “current asset” on the asset side of the Balance Sheet. The calls-in-advance are shown under current liabilities till they are adjusted.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY