METHODS OF REDEMPTION OF DEBENTURES

- Redemption of Debentures in Lump-sum at Maturity:

In this case, debentures are redeemed in one lump sum at the end of the stipulated period.

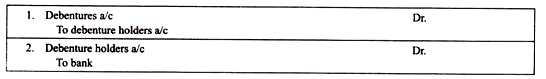

The basic accounting entries for the redemption of debentures are:

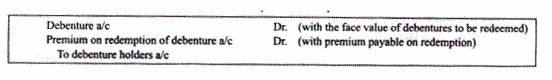

Debentures may be redeemed at par, at a premium or at a discount. When debentures are redeemed at par, the above two entries are passed. When debentures are redeemed at premium, the following accounting entries are passed.

It may be noted here that ‘premium on redemption of debentures a/c’ may have opened and credited at the time of issue of debentures. If so, then premium payable on redemption of debentures has only to be transferred to the debenture holder accounts as per the first entry. If it has not been opened earlier, it will be debited now and later closed by transferring it to securities premium a/c or profit and loss account.

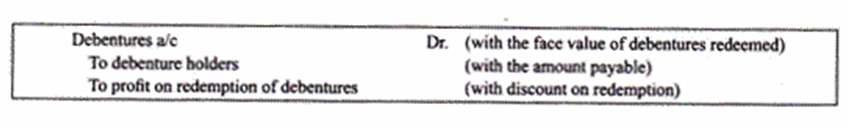

Debentures may be redeemed at a discount though it is an unreal situation and not found in practice.

However, in such a case the following entries are passed:

Profit on redemption of debentures is a capital profit. It is used to write-off discount on the issue of debentures/shares; otherwise, it will be transferred to capital reserve. Debentures may be redeemed out of capital or out of profits. Prudent companies make arrangements for the redemption of debentures from the very beginning. They set aside a certain sum of money out of profits every year and invest an equivalent amount in first-class securities so that necessary funds are available for the redemption of debentures at the appropriate time.

For investing funds outside the business, the company may follow any of the following two methods are followed:

(a) Sinking fund method/debenture redemption fund method

(b) Insurance policy method

(a) Sinking Fund Method/Debenture Redemption Fund Method:

Under this method every year the company sets aside a certain part of profits and credits the same to the debenture redemption fund. To collect the required funds at the time of redemption, it invests the same in first-class securities. The interest earned in the investments is also invested when the debentures fall due for redemption; investments are sold and sale proceeds are utilized for redeeming the debentures.

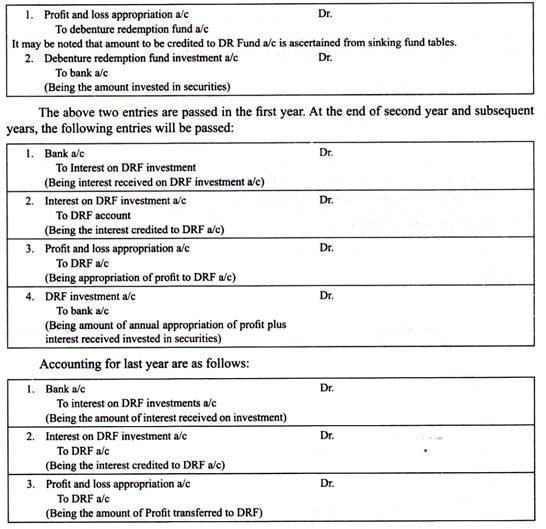

Under this method, the following accounting entries are passed:

Last year's entry for the purchase of investments will not be passed as investments are not purchased. Instead, entry for the sale of investment and redemption of debentures will be passed which are as follows:

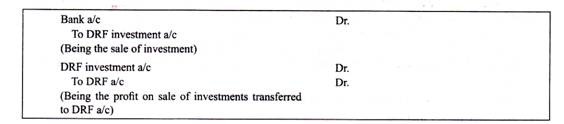

For loss on the sale of investments, reverse entry will be passed. On redemption of debentures, the following entries will be passed.

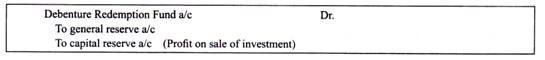

The credit balance in DRF a/c will be transferred to a general reserve account. It may be noted here that profit on sales of investment which was earlier transferred to DRF account will be transferred to capital reserve from DRF, these facts are recorded by means of following accounting entry.

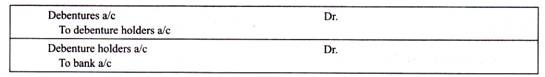

(b) Insurance policy method:

Under this method, the company instead of purchasing investments takes an insurance policy for an amount that would be adequate for the redemption of debentures.

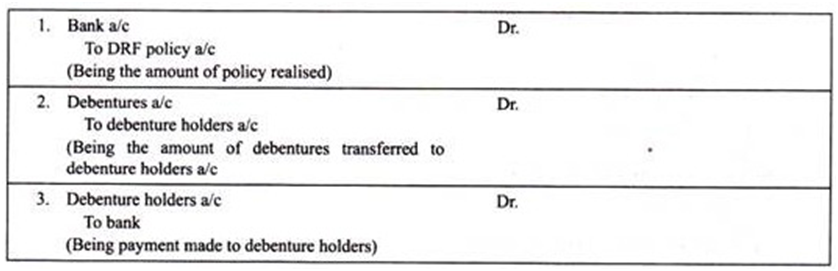

Accounting entries, under this method, are as follows:

First-year and subsequent years (including last year)

In the last year, when policy amount is realized and debentures are redeemed, the

following accounting entries are passed.

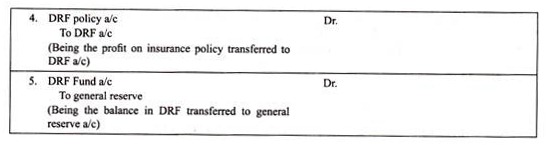

II. Redemption of Debentures by Draw of Lots:

Under this method, the company redeems debentures each year. The debentures to be redeemed are selected by the draw of lots. Accounting entries for the redemption of debentures are the same as passed in case debentures are redeemed out of profits.

They are as follows:

When all the debentures are redeemed, the balance in DRR account will be transferred to the general reserve.

III. Redemption of Debentures by purchasing them in the Open Market:

Sometimes the company purchases the debentures in the open market at its convenience and redeems them. The company may purchase the debentures at par or at a premium or at discount.

Accounting entries for the purchase of debentures at par will be as follows:

![]()

If the company purchases the debentures at a premium, the amount paid in excess of the face value will be debited to ‘loss on redemption of debentures which will be transferred to the profit and loss account and closed, and the entry will be

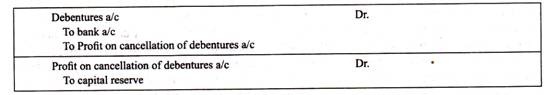

If the company pays a price that is less than the nominal value of the debentures, the company will make a profit. The entry will be

The concept of Own Debentures:

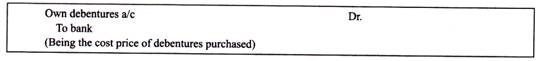

Sometimes the company may purchase its debentures from the market and, instead of canceling them, may keep them as investments. In such a case, the cost price of debentures purchased is debited to a new account known as ‘own debentures account’. Own debentures may be utilized for reissue when needed afterward.

Accounting entries for own debentures are:

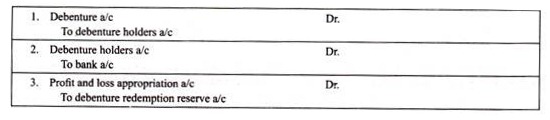

On Cancellation of Own Debentures:

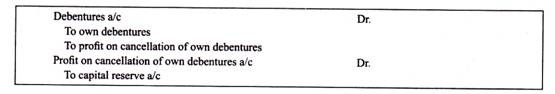

When the actual price paid on purchase of own debentures is less than the face value of debentures, there will be profit on the cancellation of own debentures.

Accounting entry will be:

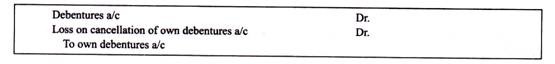

However, if the price paid on its own debentures is more than the face value of debentures, the company will make a loss on cancellations of its own debentures.

Accounting entry will be as under:

Loss on cancellation of own debentures will be transferred to the P&L account.

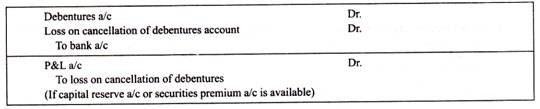

IV. Redemption of Debentures by Conversion:

Sometimes a company redeems debentures by converting them into a new class of shares or debentures. If new debentures are issued in place of old debentures, the accounting entry will be

![]()

In case debentures are redeemed by converting them into equity shares, the entry will be

![]()

If the debentures are converted into equity shares at a premium the accounting entry will be

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY