LIQUIDITY RATIOS

Ratio analysis is the quantitative interpretation of the company’s financial performance. It provides valuable information about the organization’s profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements.

The following are the different types of ratios that are considered;

A liquidity ratio is a type of financial ratio used to determine a company’s ability to pay its short-term debt obligations. The metric helps determine if a company can use its current, or liquid, assets to cover its current liabilities

Types of Liquidity Ratios

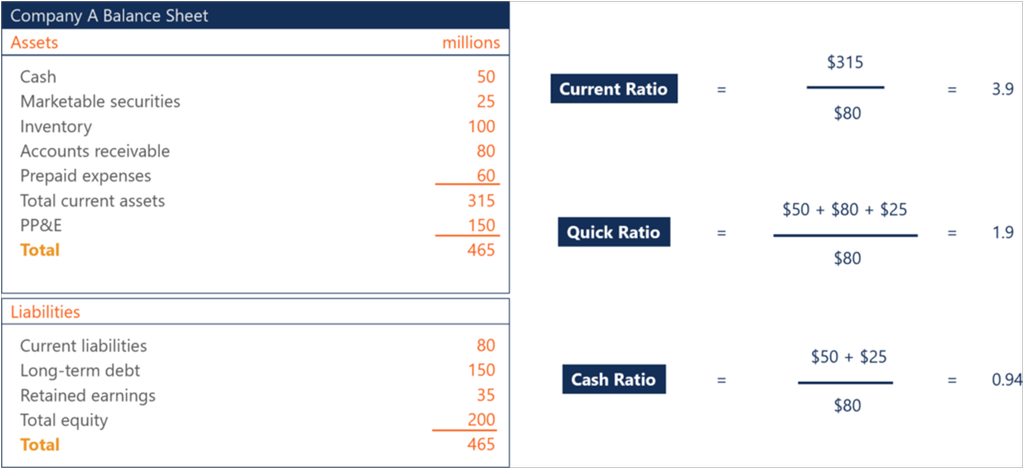

1. Current Ratio

Current Ratio = Current Assets / Current Liabilities

The current ratio is the simplest liquidity ratio to calculate and interpret. Anyone can easily find the current assets and current liabilities line items on a company’s balance sheet. Divide current assets by current liabilities, and you will arrive at the current ratio.

2. Quick Ratio

Quick Ratio = (Cash + Accounts Receivables + Marketable Securities) / Current Liabilities

The quick ratio is a stricter test of liquidity than the current ratio. Both are similar in the sense

that current assets is the numerator, and current liabilities is the denominator.

However, the quick ratio only considers certain current assets. It considers more liquid assets such as cash, accounts receivables, and marketable securities. It leaves out current assets such as inventory and prepaid expenses because the two are less liquid. So, the quick ratio is more of a true test of a company’s ability to cover its short-term obligations.

3. Cash Ratio

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

The cash ratio takes the test of liquidity even further. This ratio only considers a company’s most liquid assets – cash and marketable securities. They are the assets that are most readily available to a company to pay short-term obligations.

In terms of how strict the tests of liquidity are, you can view the current ratio, quick ratio, and cash ratio as easy, medium, and hard.

Important Notes

Since the three ratios vary by what is used in the numerator of the equation, an acceptable ratio will differ between the three. It is logical because the cash ratio only considers cash and marketable securities in the numerator, whereas the current ratio considers all current assets.

Therefore, an acceptable current ratio will be higher than an acceptable quick ratio. Both will be higher than an acceptable cash ratio. For example, a company may have a current ratio of 3.9, a quick ratio of 1.9, and a cash ratio of 0.94. All three may be considered healthy by analysts and investors, depending on the company.

Importance of Liquidity Ratios

1. Determine the ability to cover short-term obligations

Liquidity ratios are important to investors and creditors to determine if a company can cover their short-term obligations, and to what degree. A ratio of 1 is better than a ratio of less than 1, but it isn’t ideal.

Creditors and investors like to see higher liquidity ratios, such as 2 or 3. The higher the ratio is, the more likely a company is able to pay its short-term bills. A ratio of less than 1 means the company faces a negative working capital and can be experiencing a liquidity crisis.

2. Determine creditworthiness

Creditors analyze liquidity ratios when deciding whether or not they should extend credit to a company. They want to be sure that the company they lend to have the ability to pay them back. Any hint of financial instability may disqualify a company from obtaining loans.

Solvency ratios should not be confused with liquidity ratios. They are totally different. Liquidity ratios determine the capability of a business to manage its short-term liabilities while the solvency ratios are used to measure a company’s ability to pay long-term debts.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY