CONCEPT & MEANING

An acknowledgment of a debt is called a debenture. In India, debentures and bonds are treated as same. The difference lies in its issuance. When it is issued by private companies, it is called debentures but when it is issued by government companies, it is called bonds. Debentures basically include debenture stock, bonds and any other securities of a company whether contributing a charge on the company’s assets or not.

The debenture holders are paid a fixed rate of interest on their investments. If the debentures are secured, then they are given priority over other creditors in terms of payment of interest.

Debenture: A debenture is an acknowledgment of a debt. It is a source of long-term finance for the company. The debenture holders are treated as creditors of the company and are paid interest on their investment.

What Are Debentures?

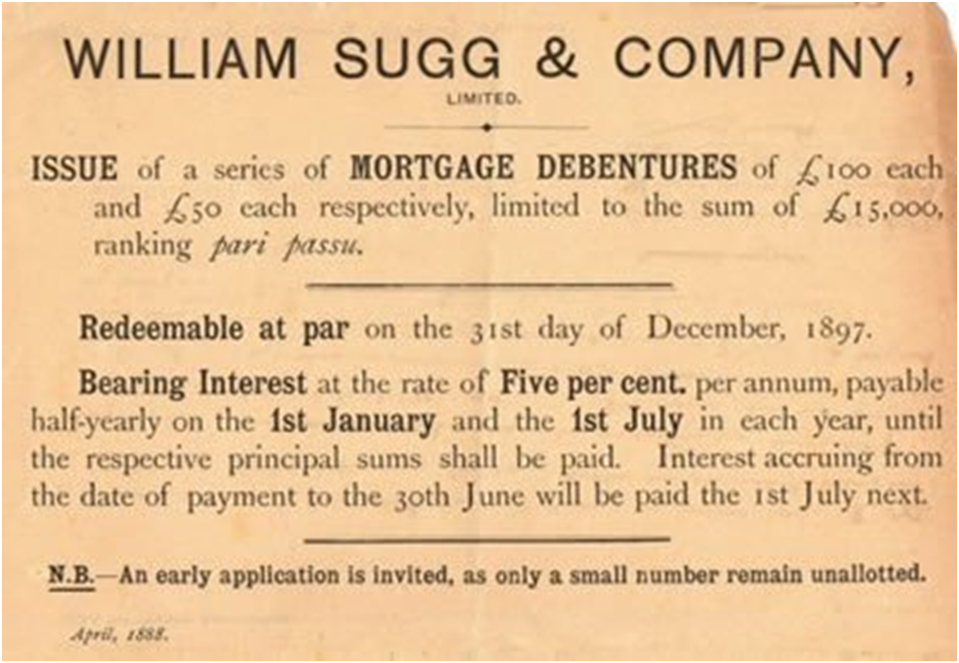

The word ‘debenture’ is derived from the Latin word ‘debate’ which refers to borrow. A debenture is a written tool acknowledging a debt under the general authentication of the enterprise. It comprises an agreement for repayment of principal after a specific period or at the option of the enterprise and for payment of interest at a fixed rate, usually either yearly on fixed dates. According to section 2(30) of The Companies Act, 2013 ‘Debenture’ comprises – Debenture Inventory, Bonds and any other securities of an enterprise whether comprising a charge on the assets of the enterprise or not.

Different Types of Debentures:

1. From the Point of view of Security

- Secured Debentures: Secured debentures are the kind of debentures where a charge is being established on the properties or assets of the enterprise for the purpose of any payment. The charge might be either floating or fixed. The fixed charge is established against those assets which come under the enterprise’s possession for the purpose to use in activities not meant for sale whereas the floating charge comprises all assets excluding those accredited to the secured creditors. A fixed charge is established on a particular asset whereas a floating charge is on the general assets of the enterprise.

- Unsecured Debentures: They do not have a particular charge on the assets of the enterprise. However, a floating charge may be established on these debentures by default. Usually, these types of debentures are not circulated.

2. From the Point of view of Tenure

- Redeemable Debentures: These debentures are those debentures that are due on the cessation of the time frame either in a lump sum or in installments during the lifetime of the enterprise. Debentures can be reclaimed either at a premium or at par.

- Irredeemable Debentures: These debentures are also called Perpetual Debentures as the company doesn’t give any attempt the repayment money acquired or borrowed by circulating such debentures. These debentures are repayable on the closing up of an enterprise or on the expiry (cessation) of a long period.

3. From the Point of view of Convertibility

- Convertible Debentures: Debentures that are changeable to equity shares or in any other security either at the choice of the enterprise or the debenture holders are called convertible debentures. These debentures are either entirely convertible or partly changeable.

- Non-Convertible Debentures: The debentures which can’t be changed into shares or in other securities are called Non-Convertible Debentures. Most debentures circulated by enterprises fall in this class.

4. From a Coupon Rate Point of view

- Specific Coupon Rate Debentures: Such debentures are circulated with a mentioned rate of interest, and it is known as the coupon rate.

- Zero-Coupon Rate Debentures: These debentures don’t normally carry a particular rate of interest. In order to restore the investors, such types of debentures are circulated at a considerable discount and the difference between the nominal value and the circulated price is treated as the amount of interest associated with the duration of the debentures.

5. From the view Point of Registration

- Registered Debentures: These debentures are such debentures within which all details comprising addresses, names and particulars of holding of the debenture holders are filed in a register kept by the enterprise. Such debentures can be moved only by performing a normal transfer deed.

- Bearer Debentures: These debentures are debentures that can be transferred by way of delivery and the company does not keep any record of the debenture holders Interest on debentures is paid to a person who produces the interest coupon attached to such debentures.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY