- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Distinction between Capital and Revenue

The revenue items form part of the trading and profit and loss account, the capital items help in the preparation of a balance sheet.

Expenditure

The expenditures are incurred with a viewpoint they would give benefits to the business. Whenever payment or incurrence of an outlay are made for a purpose other than the settlement of an existing liability, it is called expenditure. The benefit of expenditure may extend up to one accounting year or more than one year.

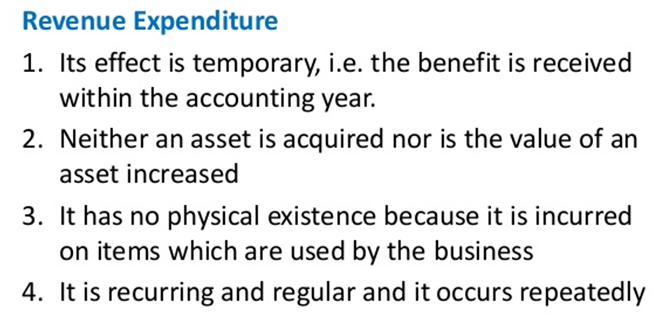

If the benefit of expenditure extends up to one accounting period, it is termed as revenue expenditure.

Normally, they are incurred for the day-to-day conduct of the business.

For example can be payment of salaries, rent, etc. The salaries paid in the current period will not benefit the business in the next accounting period, as the workers have put in their efforts in the current accounting period. They will have to be paid the salaries in the next accounting period as well if they are made to work.

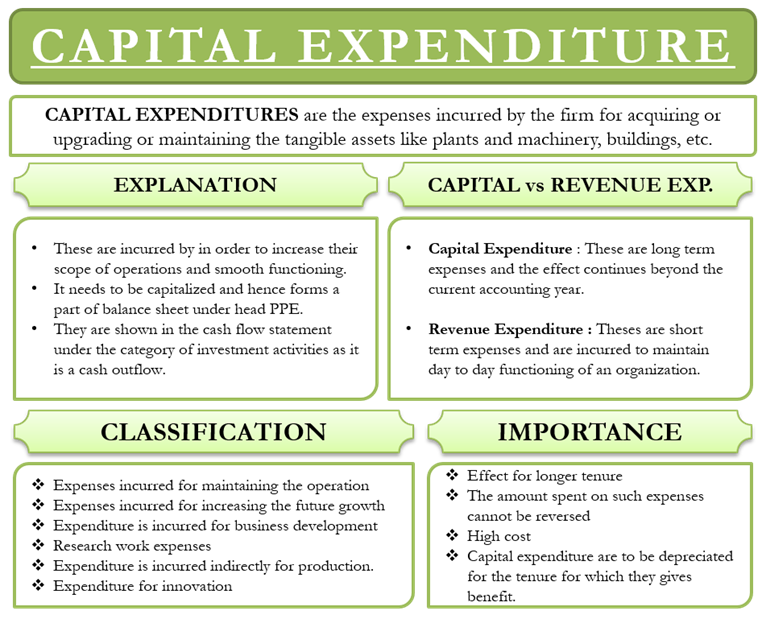

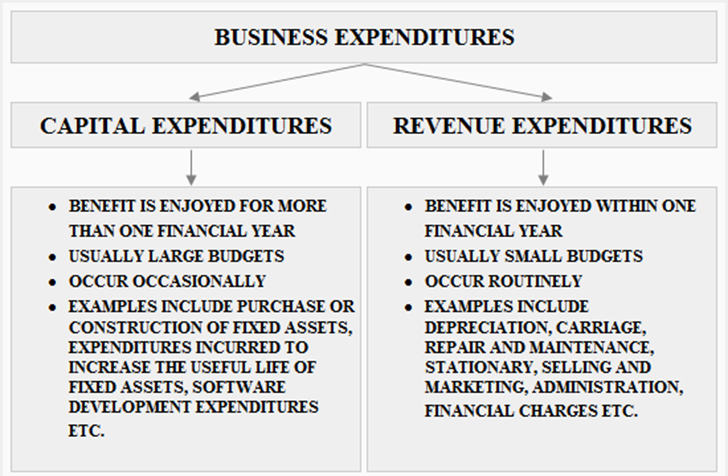

If the benefit of expenditure extends more than one accounting period, it is termed as capital expenditure.

For example can be payment to acquire furniture for use in the business. Furniture acquired in the current accounting period will give benefits for many accounting periods to come. The usual examples of capital expenditure can be payment to acquire fixed assets and/or to make additions/ extensions in the fixed assets.

Following points of distinction between capital expenditure and revenue expenditure are worth noting:

- Capital expenditure increases earning capacity of business whereas revenue expenditure is incurred to maintain the earning capacity.

- Capital expenditure is incurred to acquire fixed assets for operation of business whereas revenue expenditure is incurred on day-to-day conduct of business.

- Revenue expenditure is generally recurring expenditure and capital expenditure is non-recurring by nature.

- Capital expenditure benefits more than one accounting year whereas revenue expenditure normally benefits one accounting year.

- Capital expenditure (subject to depreciation) is recorded in balance sheet whereas revenue expenditure (subject to adjustment for outstanding and prepaid amount) is transferred to trading and profit and loss account.

Sometimes, it becomes difficult to classify the expenditure into revenue or capital category. In normal usage, the advertising expenditure is termed as revenue expenditure. The heavy expenditure incurred on advertising is likely to benefit the business firm for more than one accounting period. Such revenue expenditures, which are likely to give benefit for more than one accounting period, are termed as deferred revenue expenditure.

The part of the expenditure, which is perceived to have been used or consumed in the current year, is termed as expense of the current year.

Revenue expenditure is treated as an expense for the current year and is shown in trading and profit and loss account. For example, salary paid by the business firm is treated as an expense of the current year. Capital expenditures are charged to income statement and are spread over to more than one accounting period.

Receipts

If the receipts imply an obligation to return the money, these are capital receipts. The example can be an additional capital brought in by the owner or a loan taken from the bank. Both receipts are leading to obligations, the first to the owner (called equity) and the other to the outsiders (called liabilities).

Importance of Distinction between Capital and Revenue

The distinction between capital and revenue items has important implications for the preparation of trading and profit and loss account and the balance sheet as all items of revenue value are to the shown in the trading and profit and loss account and the items of capital nature in the balance sheet.

If any capital expenditure is wrongly shown as revenue expenditure (for example, purchase of furniture shown as purchases), it will result in under statement of profits, and also an under statement of assets. Thus, the financial statements will not reflect the true and fair view of the affairs of the business. Hence, it is necessary to identify the correct nature of each item and treat it accordingly in the book of accounts. It is also important from taxation point of view because capital profits are taxed differently from revenue profits.

Vision classes

Vision classes