- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Balance Sheet

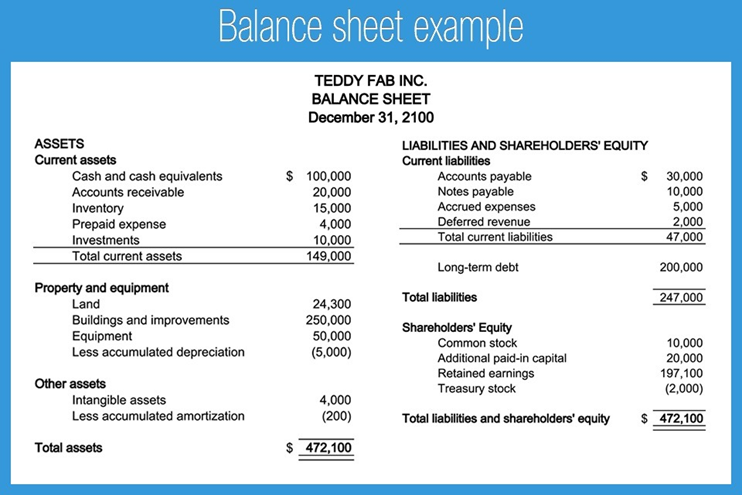

Balance Sheet is the financial statement of a company which includes assets, liabilities, equity capital, total debt, etc. at a point in time. Balance sheet includes assets on one side, and liabilities on the other. For the balance sheet to reflect the true picture, both heads (liabilities & assets) should tally (Assets = Liabilities + Equity).

Balance sheet is more like a snapshot of the financial position of a company at a specified time, usually calculated after every quarter, six months or one year. Balance Sheet has two main heads –assets and liabilities.

Preparing Balance Sheet

It is prepared at the end of the accounting period after the trading and profit and loss account have been prepared. It is called balance sheet because it is a statement of balances of ledger accounts that have not been transferred to trading and profit and loss account and are to be carried forward to the next year with the help of an opening entry made in the journal at the beginning of the next year all the account of assets, liabilities and capital are shown in the balance sheet. Accounts of capital and liabilities are shown on the left-hand side, known as Liabilities. Assets and other debit balances are shown on the right-hand side, known as Assets.

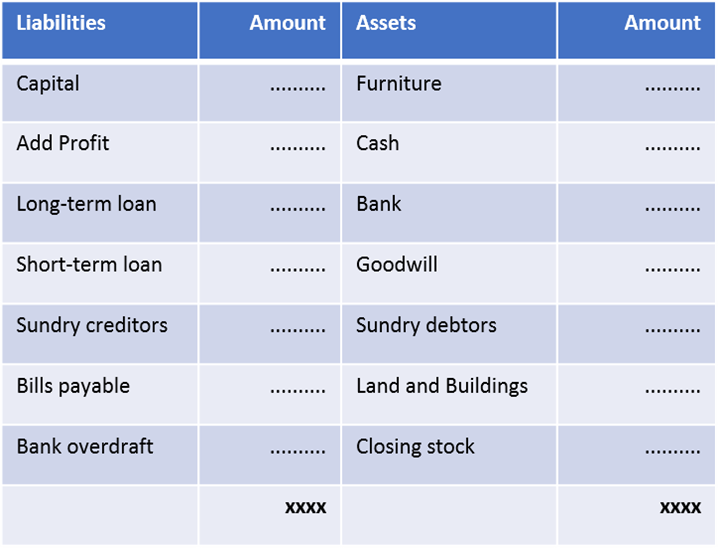

The horizontal format in which the balance sheet is prepared is shown in the figure

Format of a balance sheet

Relevant Items in the Balance Sheet

Current Assets: Current assets are those which are either in the form of cash or a can be converted into cash within a year. The examples of such assets are cash in hand/bank, bills receivable, stock of raw materials, semi-finished goods and finished goods, sundry debtors, short term investments, prepaid expenses, etc.

Current Liabilities: Current liabilities are those liabilities which are expected to be paid within a year and which are usually to be paid out of current assets. The examples of such liabilities are bank overdraft, bills payable, sundry creditors, short-term loans, outstanding expenses, etc.

Fixed Assets: Fixed assets are those assets, which are held on a long-term basis in the business. Such assets are not acquired for the purpose of resale, e.g. land, building, plant and machinery, furniture and fixtures, etc. Sometimes the term 'Fixed Block' or 'Block Capital' is also used for them.

Intangible Assets: These are such assets which cannot be seen or touched. Goodwill, Patents, Trademarks are some of the examples of intangible assets.

Investments: Investments represent the funds invested in government securities, shares of a company, etc. They are shown at cost price. If, on the date of preparation the balance sheet, the market price of investments is lower than the cost price, a footnote to that effect may be appended to the balance sheet.

Long-term Liabilities: All liabilities other than the current liabilities are known as long-term liabilities. Such liabilities are usually payable after one year of the date of the balance sheet. The important items of long term liabilities are long-term loans from bank and other financial institutions.

Capital: It is the excess of assets over liabilities due to outsiders. It represents the amount originally contributed by the proprietor/ partners as increased by profits and interest on capital and decreased by losses drawings and interest on drawings.

Drawings: Amount withdrawn by the proprietor is termed as drawings and has the effect of reducing the balance on his capital account. Therefore, the drawings account is closed by transferring its balance to his capital account. However it is shown by way of deduction from capital in the balance sheet.

Grouping of Assets and Liabilities

The term grouping means putting together items of similar nature under a common heading. For example, the balance of accounts of cash, bank, debtors, etc. can be grouped and shown under the heading of 'current assets' and the balances of all fixed assets and long-term investment under the heading of 'non-current assets'.

Vision classes

Vision classes