- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter -7

Depreciation, provisions & reserves

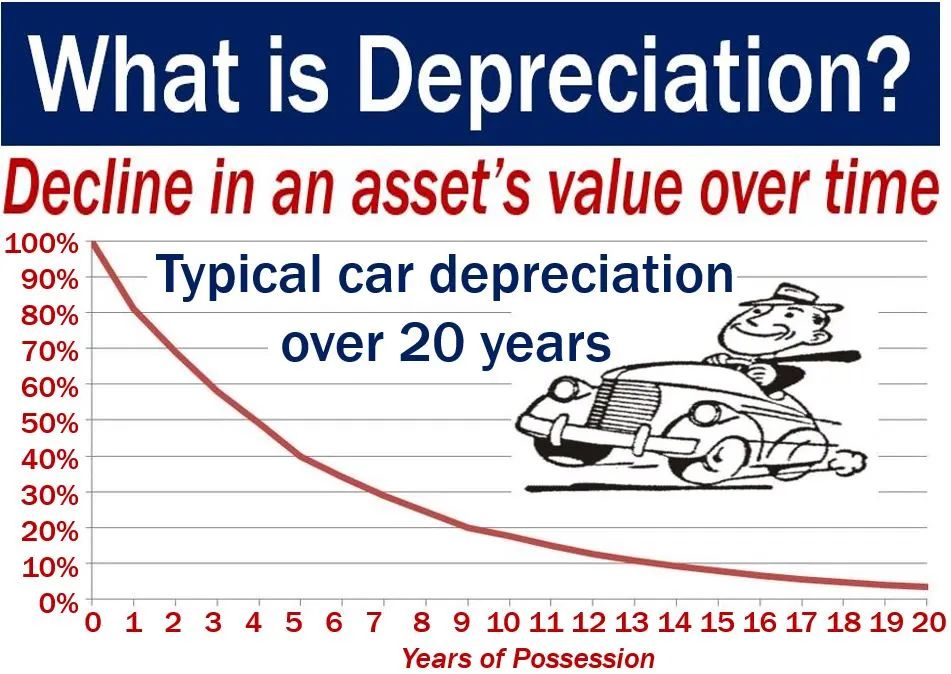

Depreciation

The fixed assets are the assets which are used in business for more than one accounting year. Fixed assets technically referred to as "depreciable assets". The term "Depreciation" means decline in the value of a fixed assets due to use, passage of time or obsolescence. We can sat, if a business enterprise procures a machine and uses it in production process then the value of machine declines with its usage. Even if the machine is not used in production process, we can not expect it to realise the same sales price due to the passage of time or arrival of a new model.

It implies that fixed assets are subject to decline in value and this decline is technically referred to as depreciation.

Depreciation is that part of the cost of a fixed asset which has expired on account of its usage and/or lapse of time. Hence, depreciation is an expired cost or expense, charged against the revenue of a given accounting period. The expired cost or loss in the value of machine on account of its use or passage of time and is referred to as 'Depreciation'. The amount of depreciation, being a charge against profit, is debited to Income Statement (Statement of Profit and Loss).

Meaning of Depreciation

It is based on the cost of assets consumed in a business and not on its market value. It may be described as a permanent, continuing and gradual shrinkage in the book value of fixed assets.

Institute of Cost and Management Accounting, London (ICMA) terminology "The depreciation is the diminution in intrinsic value of the asset due to use and/or lapse of time."

The Institute of Chartered Accountants of India (ICAI) defines depreciation as "a measure of the wearing out, consumption or other loss of value of depreciable asset arising from use, efflux ion of time or obsolescence through technology and market-change.

Depreciation has a significant effect in determining and presenting the financial position and results of operations of an enterprise. Depreciation is charged in each accounting period by reference to the extent of the depreciable amount. It should be noted that the subject matter of depreciation, or its base, are 'depreciable' assets which:

- are expected to be used during more than one accounting period.

- have a limited useful life.

- are held by an enterprise for use in production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Examples of depreciable assets - are machines, plants, furniture, buildings, computers, trucks, vans, equipments, etc. Moreover, depreciation is the allocation of 'depreciable amount', which is the "historical cost", or other amount substituted for historical cost less estimated salvage value.

Another point in the allocation of depreciable amount is the 'expected useful life' of an asset. It has been described as "either

- The period over which a depreciable asset is expected to the used by the enterprise.

- The number of production of similar units expected to be obtained from the use of the asset by the enterprise."

Features of Depreciation

1. It is decline in the book value of fixed assets.

2. It includes loss of value due to efflux ion of time, usage or obsolescence.

3. It is a continuing process.

4. It is an expired cost and hence must be deducted before calculating taxable profits. For example, if profit before depreciation and tax is f 50,000, and depreciation is f 10,000; profit before tax will be:

Profit before depreciation & tax 50,000

(-) Depreciation (10, 000)

Profit before tax 40,000

5. It is a non-cash expense. It does not involve any cash outflow. It is the process of writing-off the capital expenditure already incurred.

Depreciation and other Similar Terms

‘Depletion' and 'amortization', are also used in connection with depreciation. This has been due to the similar treatment given to them in accounting on the basis of similarity of their outcome, as they represent the expiry of the usefulness of different assets.

Depletion

The term depletion is used in the context of extraction of natural resources like mines, quarries, etc. that reduces the availability of the quantity of the material or asset. For example, if a business enterprise is into mining business and purchases a coal mine for f 10,00,000. Then the value of coal mine declines with the extraction of coal out of the mine. This decline in the value of mine is termed as depletion.

The main difference between depletion and depreciation is that the former is concerned with the exhaution of economic resources, but the latter relates to the usage of an asset. In spite of this, the result is erosion in the volume of natural resources and expiry of the service potential. Therefore, depletion and depreciation are given similar accounting treatment.

Causes of Depreciation

Wear and Tear due to Use or Passage of Time

It reduces the asset's technical capacities to serve the purpose for, which it has been meant. Another aspect of wear and tear is the physical deterioration. An asset deteriorates simply with the passage of time, even though they are not being put to any use. This happens especially when the assets are exposed to the rigours of nature like weather, winds, rains, etc.

Expiration of Legal Rights

Certain categories of assets lose their value after the agreement governing their use in business comes to an end after the expiry of pre-determined period. Examples of such assets are patents, copyrights, leases, etc. whose utility to business is extinguished immediately upon the removal of legal backing to them.

Obsolescence

Obsolescence means the fact of being "out-of-date". Obsolescence implies to an existing asset becoming out-of-date on account of the availability of better type of asset.

It arises from such factors as:

- Technological changes;

- Improvements in production methods;

- Change in market demand for the product or service output of the asset;

- Legal or other description.

Abnormal Factors

Decline in the usefulness of the asset may be caused by abnormal factors such as accidents due to fire, earthquake, floods, etc. Accidental loss is permanent but not continuing or gradual. For example, a car which has been repaired after an accident will not fetch the same price in the market even if it has not been used.

Need for Depreciation

The need for providing depreciation in accounting records arises from conceptual, legal, and practical business consideration. These considerations provide depreciation a particular significance as a business expense.

Matching of Costs and Revenue: Every asset is bound to undergo some wear and tear, and hence lose value, once it is put to use in business. Therefore, depreciation is as much the cost as any other expense incurred in the normal course of business like salary, carriage, postage and stationary, etc. It is a charge against the revenue of the corresponding period and must be deducted before arriving at net profit according to 'Generally Accepted Accounting Principles'.

Consideration of Tax: Depreciation is a deductible cost for tax purposes. However, tax rules for the calculation of depreciation amount need not necessarily be similar to current business practices,

True and Fair Financial Position: If depreciation on assets is not provided for, then the assets will be overvalued and the balance sheet will not depict the correct financial position of the business. Also, this is not permitted either by established accounting practices or by specific provisions of law.

Compliance with Law: Apart from tax regulations, there are certain specific legislations that indirectly compel some business organisations like corporate enterprises to provide depreciation on fixed assets.

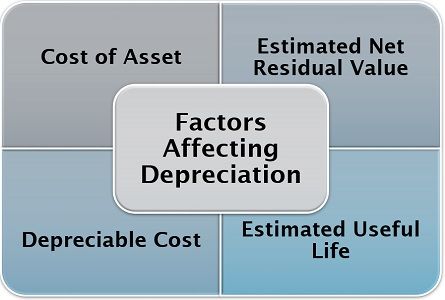

Factors Affecting the Amount of Depreciation

Cost of Asset: Cost of an asset includes invoice price and other costs, which are necessary to put the asset in use or working condition. It also includes freight and transportation cost, transit insurance, installation cost, registration cost, commission paid on purchase of asset adds items such as software, etc. In case of purchase of a second hand asset it includes initial repair cost to put the asset in workable condition.

Estimated Net Residual Value: It is the estimated net realisable value (or sale value) of the asset at the end of its useful life. It is also known as scrap value or salvage value for accounting purpose. The net residual value is calculated after deducting the expenses necessary for the disposal of the asset.

Depreciable Cost: It is the cost, which is distributed and charged as depreciation expense over the estimated useful life of the asset. It is important to mention that total amount of depreciation charged over the useful life of the asset must be equal to the depreciable cost. If total amount of depreciation charged is less than the depreciable cost then the capital expenditure is under recovered. It violates the principle of proper matching of revenue and expense.

Estimated Useful Life: It is the estimated economic or commercial life of the asset. Physical life is not important for this purpose because an asset may still exist physically but may not be capable of commercially viable production. For example, a machine is purchased and it is estimated that it can be used in production process for 5 years. After 5 years the machine may still be in good physical condition but can't be used for production profitably, i.e., if it is still used the cost of production may be very high. Therefore, the useful life of the machine is considered as 5 years irrespective of its physical life. Estimation of useful life of an asset is difficult as it depends upon several factors such as usage level of asset, maintenance of the asset, technological changes, market changes, etc. Normally, useful life is shorter than the physical life. The useful life of an asset is expressed in number of years but it can also be expressed in other units, e.g., number of units of output or number of working hours.

Useful life depends upon the following factors:

- Pre-determined by legal or contractual limits, e.g., in case of leasehold asset, the useful life is the period of lease.

- The number of shifts for which asset is to be used.

- Repair and maintenance policy of the business organization.

- Technological obsolescence.

- Innovation/improvement in production method.

- Legal or other restrictions.

Vision classes

Vision classes