- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Provisions

The traders create a Provision for Doubtful Debts to take care of expected loss at the time of realization from debtors. In a similar way, Provision for repairs and renewals may also be created to provide for expected repair and renewal of the fixed assets.

Examples of provisions are:

- Provision for depreciation;

- Provision for bad and doubtful debts;

- Provision for taxation;

- Provision for discount on debtors; and

- Provision for repairs and renewals.

Note: - The amount of provision for expense and loss is a charge against the revenue of the current period. Creation of provision ensures proper matching of revenue and expenses and hence the calculation of true profits.

Provisions are created by debiting the profit and loss account. In the balance sheet, the amount of provision may be shown either:

- By deduction from the concerned asset on the assets side.

- On the liabilities side of the balance sheet along with current liabilities, for example provision for taxes and provision for repairs and renewals.

Accounting Treatment for Provisions

The accounting treatment of all types of provisions is almost similar. Therefore, the accounting treatment is explained here taking up the case of provision for doubtful debts. When business transaction takes place on credit basis, debtors account is created and its balance is shown on the asset-side of the balance sheet.

These debtors may be of three types:

- Good Debtors are those from where collection of debt is certain.

- Bad Debts are those debtors from where collection of money is not possible and the amount of credit given is a certain loss.

- Doubtful Debts are those debtors who may pay but business firm is not sure about the collection of full amount from them.

The provision for doubtful debts is usually calculated as a certain percentage of the total amount due from sundry debtors after deducting/writing-off all known bad debts. Provision for doubtful debts is also called 'Provision for bad and doubtful debts'. It is created by debiting the amount of required provision to the profit and loss account and crediting it to provision for doubtful debts account.

For creating a provision for doubtful debts the following journal entry is recorded:

Profit and Loss A/c Dr. (With the amount of provision) To Provision for doubtful debts A/c

This is explained with the help of the following example

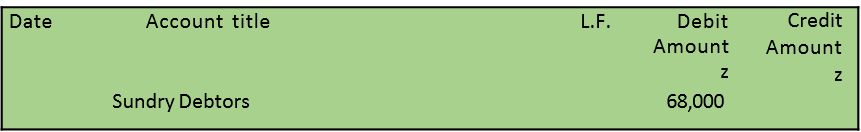

Observe an extract of the trial balance -

Additional Information

1. Bad debts proved bad but not recorded amounted to z 8,000

2. Provision is to be maintained at 10% of debtors.

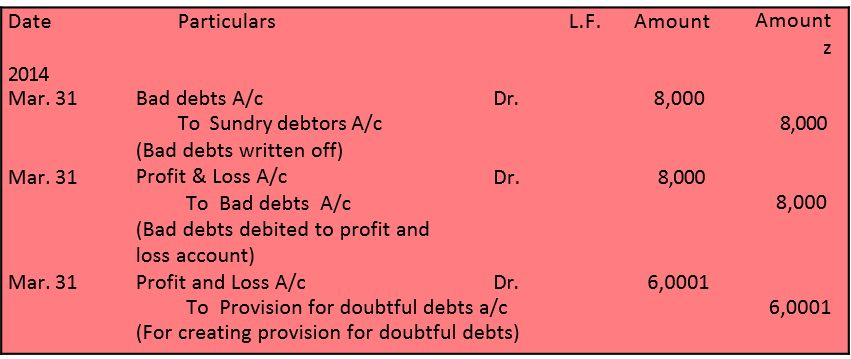

In order to create the provision for doubtful debts, the following journal entries will be recorded:

Journal

Working Notes

Provision for doubtful debts @10% of sundry debtors i.e.

Z 68,000 - Z 8000 = Z 60,000

Z 6000 x 10/100 = Z 6000

Vision classes

Vision classes