Different types of development

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

- Development involves thinking about various questions that affect the way we live as an individual or in society.

- It aims at devising ways in which we can work towards achieving these goals.

DIFFERENT TYPES OF DEVELOPMENT

- The notion of development is not the same for everyone. We seek things that play an instrumental role in fulfilling our aspirations and desires.

- Therefore, different persons can have different developmental goals.

- It is also possible that the development goals of two or more individuals or groups are conflicting.

- Hence, what may be developed for one may not be developed for the other. It may even be destructive for the other.

INCOME AND OTHER GOALS

- One thing that is usually a common development goal for everyone is regular work and decent wages. People want more income.

- However, other things people desire are respect, freedom, security, etc.

- The quality of our life depends on both material and non-material things.

- Hence, for development, people look at a mix of goals.

National Development

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

NATIONAL DEVELOPMENT

- Different individual goals lead to different notions of national development as well.

- National development involves thinking about how to ensure equality for all, resolve conflicting goals, benefit a large number of people, etc.

State vs national development

- Let us see how we can distinguish some countries as developed and under-developed.

- Usually, we take one or more important characteristics of countries and compare them based on these characteristics.

- For comparing countries, their income is considered one of the most important attributes.

- Countries with higher income are considered more developed than those with less income. The rationale behind this is that higher-income means more of all things human needs.

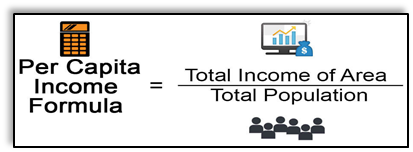

- The total income of a country is the income of all residents of a country. However, we cannot measure development using total income because the population of countries varies. This will not tell us what an average person is likely to earn.

- Therefore, we use the concept of average income. It is defined as the total income of a country divided by its total population. It is also called per capita income.

- According to World Development Reports brought by World Bank, India comes in the category of low middle-income countries.

- While averages are used for comparison, they also hide disparities.

- Even if two countries have an identical average income, it is possible that in one country, there is equitable distribution while in the other country most population is poor while a minuscule of it is rich.

Criteria for development

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

CRITERIA FOR DEVELOPMENT

- As we discussed earlier, apart from income, people have other goals such as security and freedom. Let us look at various indicators that can help to measure development:

1. Infant Mortality Rate (IMR): It indicates the number of children that die before the age of one year as a proportion of 1000 live children that are born in that particular year.

2. Literacy Rate: Measures the population of the literate population in the 7 and above age group.

3. Net Attendance ratio: Total number of children of age 14 and 15 years attending school as a percentage of the total number of children in the same age group.

- Thus, a state or country might have a good per capita income but perform poorly in the criteria mentioned above.

Government and public facilities

- Money in our pocket cannot buy us all the goods and services that we may need to live well.

- Income itself is not a complete adequate indicator of material goods and services a citizen can use. It cannot buy us a pollution-free environment or get us unadulterated food or medicines.

- collectively. More children can go to high schools if the state provides adequate facilities to its people.

- Kerala has a low infant mortality rate because it has an adequate provision of basic health and educational facilities.

- To check if we are properly nourished, we calculate Body Mass Index or BMI. It is calculated by dividing the weight (in kgs) by the square of height (in meters)

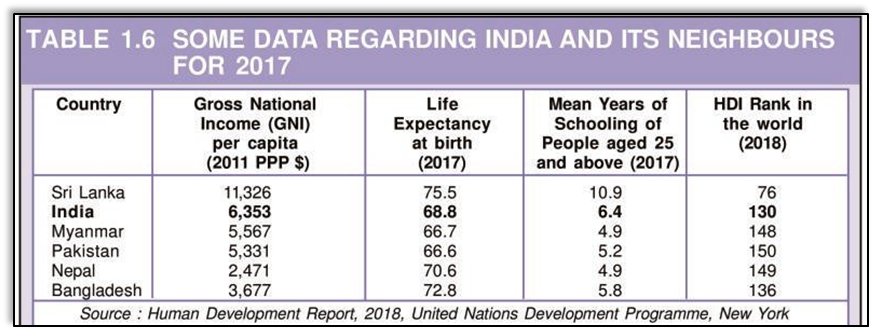

- Human Development Report: After realizing that only per capita income is an inadequate criterion to measure development, we made a small list of other important criteria. Over the past decade, health and education indicators have come to be widely used as a measure of development. The human development report published by UNDP gives an account of development using these measures.

- Here, Life Expectancy at Birth means the average expected length of life of a person at the time of birth.

- HDI stands for Human Development Index.

- Per capita income is calculated in dollars for every country to ease comparison between them.

Sustainability of Development

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

SUSTAINABLE DEVELOPMENT

- Since the second half of the twentieth century, a number of scientists are indicating that the present level of development is not sustainable.

- For example: At present, nearly 1/3rd of the country is overusing its groundwater reserve, which will exceed 60% of the country in the next 25 years. Groundwater is a renewable resource i.e. it can be replenished by nature. However, if the rate of using this resource exceeds the rate at which it is replenished, it will imply that we are overusing it.

- Non-renewable resources refer to those that will exhaust after years of use. Example: Coal and petroleum.

Making development a continuous process

- The consequences of environmental degradation are no more nation-specific.

- The sustainability of development is a new area that is being explored.

- Development is perennial. At all times, we have to figure out what we want and how to achieve it in a sustainable manner.

Differences in sectors

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

DIFFERENCES IN SECTORS

- We see a lot of activities taking place around us. This involves producing goods and services.

- To understand these activities, we divide them into different groups known as sectors.

PRIMARY, SECONDAY & TERTIARY SECTORS

- The various activities are categorized into three categories: Primary, secondary and Tertiary sectors. Let us have a look at each of them.

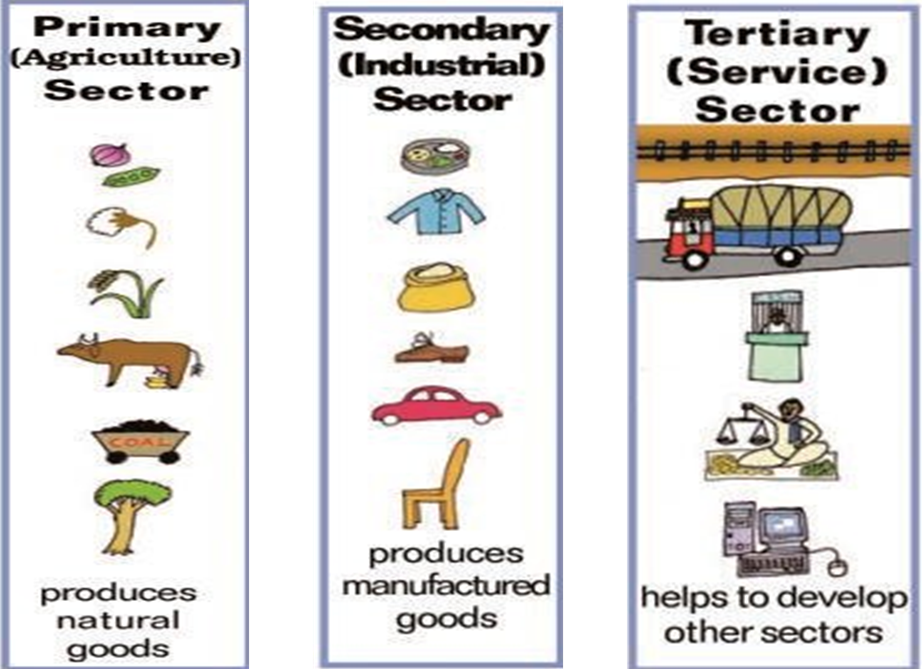

PRIMARY SECTOR

- For the growth of cotton plant, we depend mainly on rainfall, sunshine and climate. The product i.e. cotton, is a natural product. Similarly, in the case of dairy, we depend on the biological process of animals and the availability of fodder. The product here, milk, is natural. Other examples of a natural product are minerals and ores.

- When we produce a good by exploiting natural resources, it is an activity of the primary sector.

- It is called primary because it forms the base of the products that we subsequently make.

- It is also called agriculture and related sector since most of the natural products we get are from agriculture, forestry, dairy, fishing etc.

SECONDARY SECTOR

- The secondary sector, which is the second step, covers activities in which natural products are changed into other forms through ways of manufacturing that we associate with industrial activity.

- The product is not produced by nature but has to be made and therefore some process of manufacturing is essential.

- For example, the cotton that we saw in the primary sector now helps us to spin yarn and weave cloth. Using sugarcane as raw material, we make sugar or gur, the milk is used to make processed cheese etc.

- Since this sector gradually became associated with the different kinds of industries that came up, it is also called as industrial sector.

TERTIARY SECTOR

- Some activities fall neither in the category of the primary or secondary sector. They come under the tertiary sector

- These activities help in the development of the primary and the secondary sector.

- These activities, by themselves, do not produce good but they are an aid or

- support for the production process.

- For example, goods that are produced in the primary or secondary sector would need to be transported by trucks or trains and then sold in wholesale and retail shops.

- At times, it may be necessary to store these in godowns.We may need to communicate about these to consumers or maybe borrow money from banks to support them.

- Transport, storage, communication, banking, trade are some examples of tertiary activities.

- Since these activities generate services rather than goods, the tertiary sector is also called the service sector.

- It also includes additional services that do not help in the production of goods like Teaching, engineering etc.

- These sectors, although categorized differently, are interdependent.

Comparison between sectors

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

COMPARISON BETWEEN SECTORS

- Now, the question arises, how do we count the various goods and services and know total production in each sector?

- For this, we find the value of goods and services rather than the quantity. For example, if 10,000 kg of wheat is sold at Rs.8, then the value of wheat is Rs.80, 000. In this way, the value of goods and services in the three-sector is calculated and then added up.

- However, some goods and services are not included in this. They are known as intermediate goods. For example, a farmer sells wheat to a flour mill at Rs.8 per kg. The mill grinds the wheat and sells the flour to a biscuit company for Rs.10 per kg. The biscuit company uses flour and things such as sugar and oil to make four packets of biscuits. It sells biscuits in the market to consumers for Rs 60 (Rs 15 per packet). Biscuits are the final goods, i.e., goods that reach the consumers. Here, wheat and wheat flour are examples of intermediate goods and therefore will be excluded to avoid the problem of double counting.

- Thus, intermediate goods can be defined as goods that help in producing final goods and services. The value of final goods and services includes the cost of intermediate goods. In the above example, the price of biscuits is inclusive of the price of wheat.

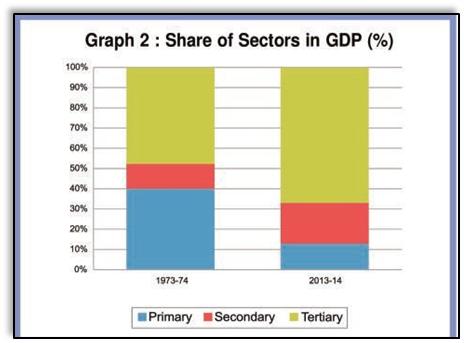

- The value of final goods and services produced in each sector during a particular year provides the total production of the sector for that year. Moreover, the sum of production in the three sectors gives what is called the Gross Domestic Product (GDP) of a country. It is the value of all final goods and services produced within a country during a particular year. GDP shows how big the economy is.

- A central government ministry undertakes GDP.

Changes in the sector with TIME

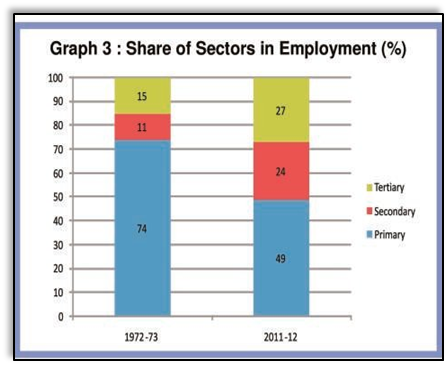

- The primary sector was the most important sector of economic activity. However, with the change in farming techniques, the agriculture sector began to prosper and produced much more food than before. Many people could now take up other activities. There was an increase in the number of craft persons and traders. Buying and selling activities increased many times. Besides, there were also transporters, administrators, army etc. However, a major section of the society was employed in the primary sector.

- Over the years, manufacturing was introduced and factories started coming up. People shifted from farming to manufacturing. The secondary sector thus gathered importance in total production and employment.

- However, another shift was observed. People started shifting from secondary to tertiary sector, which became the most important in terms of total production.

Importance of tertiary

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

IMPORTANCE OF TERTIARY

- Over the last 40 years, production in all the three sectors has increased but the maximum increase was observed in the tertiary sector.

- As a result, in the year 2013-14, the tertiary sector has emerged as the largest producing sector in India replacing the primary sector. Let us look at the reasons behind the increase in the production of the tertiary sector.

- First, in any country, several services such as hospitals, educational institutions, post and telegraph services, police stations, courts, village administrative offices, municipal corporations, defense, transport, banks, insurance companies, etc. are required. These can be considered as basic services.

- Second, the development of agriculture and industry leads to the development of services like transport, banking, insurance etc.

- Third, as income levels rise, certain sections of people start demanding many more services like eating out, tourism, shopping, private hospitals, private schools, professional training etc.

- Fourth, over the past decade or so, certain new services such as those based on information and communication technology have become essential. The production of these services has been rising rapidly.

THE MOST EMPLOYMENT GIVING SECTOR

- Even though there had been an increase in the production in all three sectors, still, more than half of the population was employed in the primary sector producing only 1/6th of the GDP, because there are not enough job opportunities in the secondary and tertiary sector.

- There are more people in agriculture than is necessary. So, even if you move a few people out, production will not be affected. In other words, workers in the agricultural sector are underemployed.

- In this case, labor effort is divided and everyone works less than their potential.

- This kind of underemployment is hidden in contrast to someone who does not have a job and is visible as unemployed. Hence, it is also called disguised unemployment.

- If we remove many people from the agricultural sector and provide them with proper work elsewhere, agricultural production will not suffer. The incomes of the people who take up other work would increase the total family income.

- This underemployment can also happen in other sectors. For example, there are thousands of casual workers in the service sector in urban areas who search for daily employment. They are employed as plumbers, painters etc. They are doing this work because they do not have better opportunities.

- However, there are certain ways to create more employment. It can be done as:

- Putting unirrigated land on use by the development of irrigation facilities (for example, construction of wells, dams etc.), will enable more crops to be produced on land and better utilization of workers.

- If the government invests some money in transportation and storage of crops or makes better rural roads so that mini-trucks reach everywhere several farmers, who now have access to water, can continue to grow and sell these crops. This activity can provide productive employment to not just farmers but also others such as those in services like transport or trade.

- We also need to provide cheap agricultural credit to the farmers for farming to improve.

- Open cold storage. It can allow farmers to store their products like potatoes and onions and sell them when the price is good.

- In villages near forest areas, we can start honey collection centers where farmers can come and sell wild honey. It is also possible to set up industries that process vegetables and agricultural produce like potato, sweet potato, rice, wheat, tomato, fruits, which can be sold in outside markets. This will employ in industries located in semi-rural areas and not necessarily in large urban centers.

- A study conducted by the erstwhile Planning Commission (now known as NITI Aayog) estimates that nearly 20 lakh jobs could be created in the education sector alone. Similarly, if we are to improve the health situation, we need many more doctors, nurses, health workers etc. to work in rural areas.

- The central government in India made a law implementing the Right to Work in about 625 districts of India. It is called Mahatma Gandhi National Rural Employment Guarantee Act 2005 (MGNREGA 2005).

- Under MGNREGA 2005, all those who can, and need, work in rural areas are guaranteed 100 days of employment in a year by the government. If the government fails in its duty to provide employment, it will give unemployment allowances to the people. The types of work that would in the future help to increase the production from land will be given preference under the Act.

Organised of an organised Sectors

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

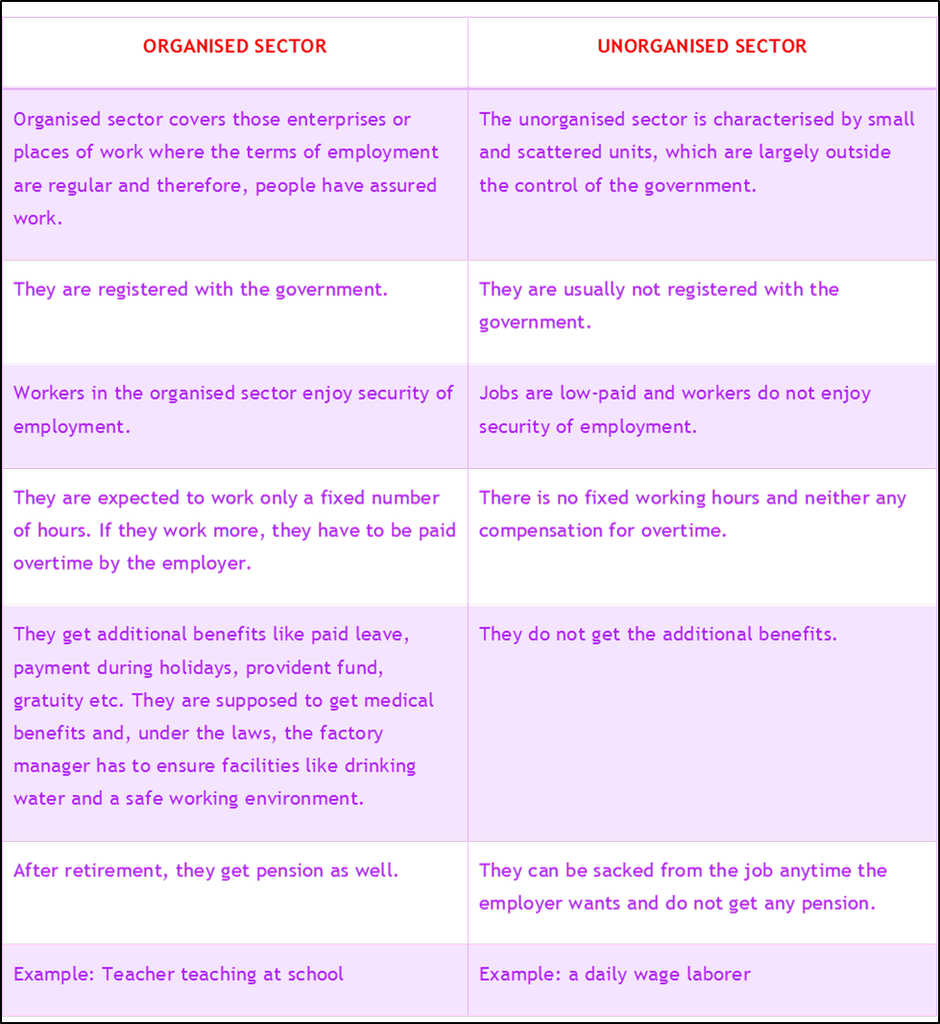

ORGANISED & UNORGANISED SECTOR

PROTECTION OF WORKERS IN UNORGANISED SECTOR

- Workers are forced to enter into unorganized sectors due to

a)lack of jobs in organized sectors

b)Some organized sector enterprises enter into unorganized sectors to evade taxes and reduce the benefits of workers. - This calls for a need for the protection and support of workers in the unorganized sector.

- In the rural areas, the unorganized sector mostly comprises landless agricultural laborers, small and marginal farmers, sharecroppers and artisans.

- Nearly 80 percent of rural households in India are in the small and marginal farmer category. These farmers need to be supported through the adequate facility for timely delivery of seeds, agricultural inputs, credit, storage facilities and marketing outlets.

- In the urban areas, the unorganized sector comprises mainly of workers in the small-scale industry, casual workers in construction, trade and transport etc., and those who work as street vendors, head load workers, garment makers, rag pickers etc. These small-scale industries need the support of the government.

- We also find that majority of workers from scheduled castes, tribes and backward communities find themselves in the unorganized sector. Besides getting irregular and low-paid work, these workers also face social discrimination.

- Protection and support to the unorganized sector workers is thus necessary for both economic and social development.

Private and Public Sector

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

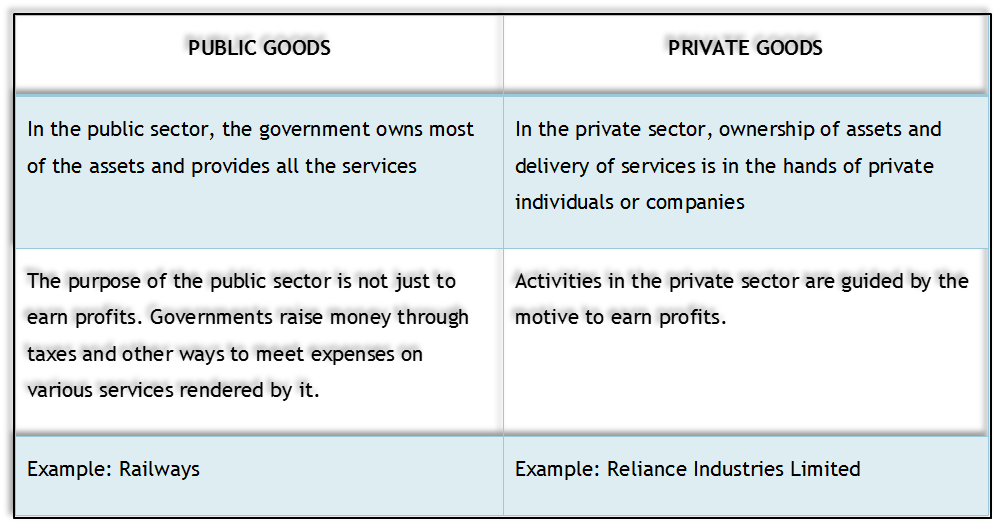

SECTORS IN TERMS OF OWNERSHIP: PUBLIC AND PRIVATE GOODS

- The services mentioned above that the government provides are as follows:

- Construction of roads, bridges, railways, harbors, generating electricity, providing irrigation through dams etc.

- Government produces and supplies services like electricity at rates that are affordable to all and encourages the continuation of various industries and activities.

- It also buys certain commodities from farmers at a fair price and sells them at lower prices at ration shops.

- Running proper schools and providing quality education, particularly elementary education.

- The government also needs to pay attention to aspects of human development such as the availability of safe drinking water, housing facilities for the poor and food and nutrition.

- It is also the duty of the government to take care of the poorest and most ignored regions of the country through increased spending in such areas.

Money as a medium

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

MONEY AS A MEDIUM

- As we look around, we see that all our transactions take place in the form of money. Whenever we buy or sell a commodity, we exchange that with money. Sometimes it is paid on the spot and sometimes it is promised to be repaid later.

- A person holding money can easily exchange it for any commodity or service that he or she might want. Thus everyone prefers to receive payments in money and then exchange the money for things that they want.

MEDIUM OF EXCHANGE

- Take the case of a shoe manufacturer. He wants to sell shoes in the market and buy wheat. The shoe manufacturer will first exchange shoes that he has produced for money, and then exchange the money for wheat. Imagine how much more difficult it would be if the shoe manufacturer had to directly exchange shoes for wheat without the use of money.

- He would have to look for a wheat-growing farmer who not only wants to sell wheat but also wants to buy the shoes in exchange. That is, both parties have to agree to sell and buy each other’s commodities.

- This is a double coincidence of wants. What a person desires to sell is exactly what the other wishes to buy. In a barter system where goods are directly exchanged without the use of money, double coincidence of wants is an essential feature.

- Whereas, in an economy where money is used, the problem of double coincidence is eliminated.

- Since money acts as an intermediate in the exchange process, it is called a medium of exchange.

Types of Money

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

TYPES OF MONEY

- Money has been used in different forms.

- Since the very early ages, Indians used grains and cattle as money.

- Thereafter came the use of metallic coins — gold, silver, copper coins — a phase which continued well into the last century.

- However, the modern forms of money include currency i.e. paper notes and coins.

- The government of the country authorizes it.

- In India, the Reserve Bank of India issues currency notes on behalf of the central government. As per Indian law, no other individual or organisation is allowed to issue currency.

- Moreover, the law legalises the use of rupees as a medium of payment. This implies that no individual in India can legally refuse a payment made in rupees. Hence, the rupee is widely accepted as a medium of exchange.

- Money is also stored as deposits in the bank.

- People sometimes save surplus money in the form of deposits by opening an account with a bank. The deposits are accepted by banks. Banks even give interest on these deposits.

- People can withdraw their money at any point in time from the bank. Since it can be withdrawn from banks on demand; they are also called demand deposits.

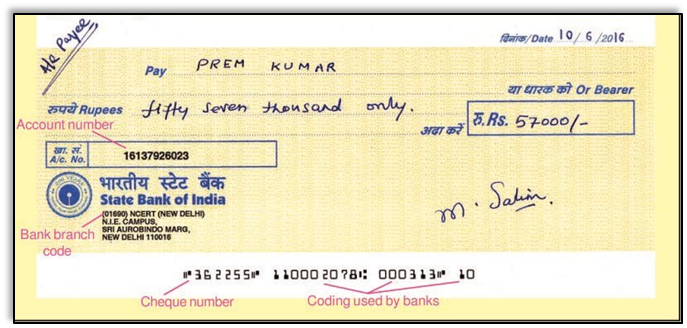

- People can make payments directly through their bank account using cheques. For payment through cheque, the payer who has an account with the bank makes out a cheque for a specific amount. A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued. Here is a picture of a cheque.

Bank activities

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

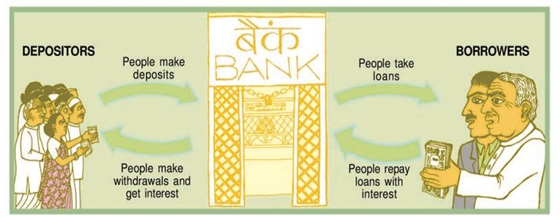

BANK ACTIVITIES

- Have you ever wondered what the bank does with your deposits?

- Banks keep only a small proportion of their deposits as cash with themselves. For example, banks in India these days hold about 15 percent of their deposits as cash. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

- Since, on any particular day, only some of its many depositors come to withdraw cash, the bank can manage with this cash. Banks use the major portion of the deposits to extend loans because there is a huge demand for loans for various economic activities.

- In this way, banks mediate between those who have surplus funds (the depositors) and those who need these funds (the borrowers).

- Banks charge a higher interest rate on loans than what they offer on deposits. The difference between what is charged from borrowers and what is paid to depositors is their main source of income.

- A large number of transactions in our day-to-day activities involve credit in some form or the other.

- Credit (loan) refers to an agreement in which the lender supplies the borrower with money, goods, or services in return for the promise of future payment. Let us look at different credit situations.

TWO DIFFERENT CREDIT SITUATIONS

- In our first situation, we have an order and to complete that within time, we obtain a credit to meet the working capital needs of production. The credit helps us to meet the ongoing expenses of production, complete production on time, and thereby increase earnings. Credit, therefore, plays a vital and positive role in this situation.

- In our other situation, let’s say crop production, the main demand for credit is to meet considerable costs on seeds, fertilizers, pesticides, water, electricity, repair of equipment, etc. There is a minimum stretch of three to four months between the time when the farmers buy these inputs and when they sell the crop. Farmers usually take crop loans at the beginning of the season and repay the loan after harvest. Repayment of the loan is crucially dependent on the income from farming. If there is a failure in the crop, loan repayment is impossible. The borrower has to repay the loan by either selling land or taking more loans. This leaves them worse off.

- Thus, we can see that credit can leave us in two situations. In one situation, credit helps to increase earnings and therefore the person is better off than before. In another situation, credit pushes the person into a debt trap.

- Every loan agreement specifies an interest rate, which the borrower must pay to the lender along with the repayment of the principal. In addition, lenders may demand collateral (security) against loans.

- Collateral is an asset that the borrower owns (such as land, building, vehicle, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid. If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

- Property such as land titles, deposits with banks, livestock is some common examples of collateral used for borrowing.

- Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit.

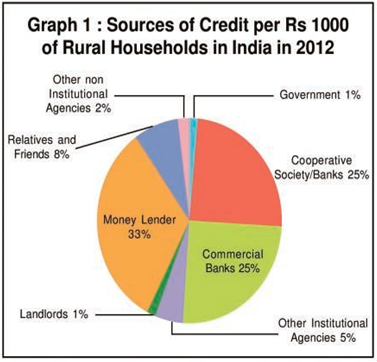

LOANS FROM COOPERATIVES :

- Besides banks, the other major source of cheap credit in rural areas are cooperative societies.

- Members of a cooperative pool their resources for cooperation in certain areas.

- It accepts deposits from its members. With these deposits as collateral, the Cooperative has obtained a large loan from the bank.

- These funds are used to provide loans to members. Once these loans are repaid, another round of lending can take place

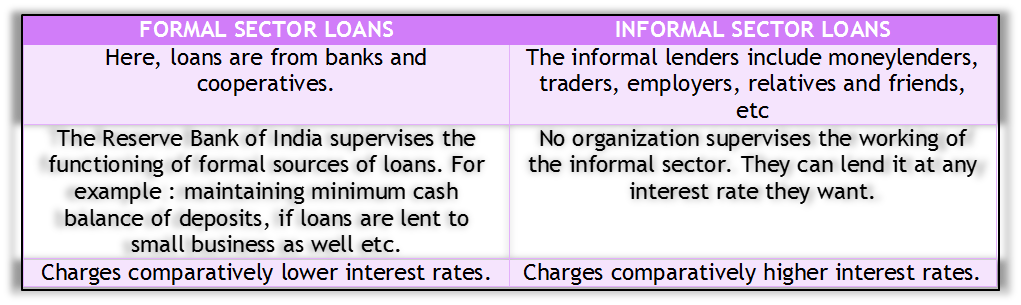

The loans can be categorized into two categories: Formal sector loans and informal sector loans. Let us look at the difference between the two.

- Is there a problem if lenders charge a high rate of interest? Indeed, yes.

- A higher cost of borrowing means a larger part of the earnings of the borrowers is used to repay the loan. Hence, borrowers have less income left for themselves. In certain cases, the high-interest rate for borrowing can mean that the amount to be repaid is greater than the income of the borrower. This could lead to increasing debt and a debt trap. In addition, people who might wish to start an enterprise by borrowing may not do so because of the high cost of borrowing.

- Cheap and affordable credit is crucial for the country’s development. That is why it is preferred that the formal sector extends cheap loans.

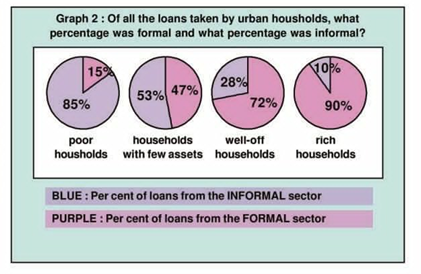

- 85 percent of the loans taken by poor households in the urban areas are from informal sources whereas only 10 percent of the urban rich households lend loans from the informal sectors.

- This implies that the formal sector meets only about half of the total credit needs of the rural people. Thus, banks and cooperatives must increase their lending particularly in the rural areas so that the dependence on informal sources of credit reduces

- Secondly, while formal sector loans need to expand, it is also necessary that everyone receives these loans

SELF HELP GROUPS FOR POOR

- The absence of collateral is one of the major reasons which prevents the poor from getting bank loans while no such thing is seen in the informal sector. However, the moneylenders charge very high rates of interest keep no records of the transactions and harass the poor borrowers.

- A new idea of Self-help groups (SHG) has been started in rural areas, particularly by women, to pool their savings.

- Saving per member varies from Rs 25 to Rs 100 or more, depending on the ability of the people to save. Members can take small loans from the group itself to meet their needs.

- The group charges interest on these loans but this is still less than what the moneylender charges. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

- The loan is sanctioned in the name of the group and is meant to create self-employment opportunities for the members.

- Most of the important decisions regarding the savings and loan activities are taken by the group members.

- The group decides as regards the loans to be granted — the purpose, amount, interest to be charged, etc. and failure of repayment of the loan by any one member is followed up seriously by other members in the group.

- SHGs are the building blocks of the organization of the rural poor. Not only does it help women to become financially self-reliant, but the regular meetings of the group also provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

Production across country

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

PRODUCTION ACROSS COUNTRY

- Until the middle of the twentieth century, production was largely organized within countries. What crossed the boundaries of these countries were the raw materials, foodstuff and finished products.

- Colonies such as India exported raw materials and foodstuff and imported finished goods. Trade was the main channel connecting distant countries.

- This was before large companies called multinational corporations (MNCs) emerged on the scene.

- An MNC is a company that owns or controls production in more than one nation. MNCs set up offices and factories for production in regions where they can get cheap labor and other resources. This is done so that the cost of production is low and the MNCs can earn greater profits.

- The MNC not only sells its finished products globally but more importantly, the goods and services are produced globally. As a result, production is organized in increasingly complex ways.

- The production process is divided into small parts and spread out across the globe.

Interlinking products across the border

- MNCs set up production where:

- It is close to the markets

- There is skilled and unskilled labor available at low costs

- The availability of other factors of production is assured

- Government policies look after their interests.

- Having assured themselves of these conditions, MNCs set up factories and offices for production.

- The money that is spent to buy assets such as land, building, machines and other equipment is called investment.

- The investment made by MNCs is called foreign investment. Any investment is made with the hope that these assets will earn profits.

- At times, MNCs set up production jointly with some of the local companies of these countries. The benefit to the local company of such joint production is two-fold.

- First, MNCs can provide money for additional investments, like buying new machines for faster production. Second, MNCs might bring with them the latest technology for production.

- However, the most common route for MNC investments is to buy up local companies and then to expand production.

- There is another way in which MNCs control production. Large MNCs in developed countries place orders for production with small producers. Garments, footwear, sports items are examples of industries where production is carried out by a large number of small producers around the world. The products are supplied

- to the MNCs, which then sell these under their own brand names to the customers.

- These large MNCs have tremendous power to determine price, quality, delivery, and labor conditions for these distant producers.

- Hence, by setting up partnerships with local companies, by using the local companies for supplies, by closely competing with the local companies, or buying them up, MNCs are exerting a strong influence on production at these distant locations.

- As a result, production in these widely dispersed locations is getting interlinked

Foreign Trade

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

FOREIGN TRADE

- Foreign trade creates an opportunity for the producers to reach beyond the domestic markets, i.e., markets of their own countries.

- Producers can sell their products not only in markets located within the country but can also compete in markets located in other countries of the world.

- Similarly, for the buyers, the import of goods produced in another country is one way of expanding the choice of goods beyond what is domestically produced.

PRODUCTS INFLOW OF OTHER COUNTRIES

- With the opening of trade, goods travel from one market to another. Choice of goods in the markets rises. Prices of similar goods in the two markets tend to become equal. Moreover, producers in the two countries now closely compete against each other even though thousands of miles separate them.

- Foreign trade thus results in connecting the markets or integration of markets in different countries.

- For example, Chinese manufacturers learn of an opportunity to export toys to India, where toys are sold at a high price. They start exporting plastic toys to India. Buyers in India now have the option of choosing between Indian and Chinese toys. Because of the cheaper prices and new designs, Chinese toys become more popular in the Indian markets.

- In the competition between Indian and Chinese toys, Chinese toys prove better. Indian buyers have a greater choice of toys and at lower prices. For the Chinese toy makers, this provides an opportunity to expand their business. The opposite is true for Indian toy makers. They face losses, as their toys are selling much less.

Globalisation

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

GLOBALISATION

- Foreign investment by MNCs in various countries has been rising. At the same time, foreign trade between countries has been rising rapidly. A large part of the foreign trade is also controlled by MNCs.

- The result of greater foreign investment and greater foreign trade has been greater integration of production and markets across countries.

MEANING AND CONCEPT

- Globalization is this process of rapid integration or interconnection between countries.

- MNCs are playing a major role in the globalization process. More and more goods and services, investments and technology are moving between countries.

- Besides the movements of goods, services, investments and technology, there is one more way in which the countries can be connected. This is through the movement of people between countries.

- People usually move from one country to another in search of better income, better jobs, or better education.

Factors related Globalisation

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

FACTORS RELATED TO GLOBALISATION

Let us have a glimpse at different factors that led to globalization:

- Transportation technology: This has made much faster delivery of goods across long distances possible at lower costs.

- Information and communication technology: In recent times, technology in the areas of telecommunications, computers, Internet has been changing rapidly. Telecommunication facilities (telegraph, telephone including mobile phones, fax) are used to contact one another around the world, to access information instantly, and to communicate from remote areas. Satellite communication devices have facilitated this. The Internet also allows us to send instant electronic mail (e-mail) and talk (voice-mail) across the world at negligible costs.

TRADE RULES

- Let us recall the example of the import of Chinese toys. Suppose the Indian government puts a tax on the import of toys. This implies that those who wish to import these toys would have to pay tax on this. Because of the tax, buyers will have to pay a higher price on imported toys. Chinese toys will no longer be as cheap in the Indian markets and imports from China will automatically reduce. Indian toy-makers will prosper.

- Tax on imports is an example of a trade barrier. It is called a barrier because some restriction has been set up. Governments can use trade barriers to increase or decrease (regulate) foreign trade and to decide what kinds of goods and how much of each, should come into the country.

- The Indian government, after Independence, had put barriers to foreign trade and foreign investment, which were necessary to protect the budding Indian industries.

- Starting around 1991, the government decided that the time had come for Indian producers to compete with producers around the globe to improve the performance of Indian industries affected by the competition. Thus, barriers to foreign trade and foreign investment were removed largely.

- This meant that goods could be imported and exported easily and foreign companies could set up factories and offices here. Removing barriers or restrictions set by the government is what is known as liberalization. With the liberalization of trade, businesses are allowed to make decisions freely about what they wish to import or export. The government imposes much fewer restrictions than before and is therefore said to be more liberal.

World Trade Organisation

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

WORLD TRADE ORGANISATION

- World Trade Organisation (WTO) is an organisation whose aim is to liberalise international trade. Started at the initiative of the developed countries, WTO establishes rules regarding international trade, and sees that these rules are obeyed.

RULES AND REGULATIONS OF WTO

- Though WTO is supposed to allow free trade for all, in practice, it is seen that the developed countries have unfairly retained trade barriers. On the other hand, WTO rules have forced developing countries to remove trade barriers.

IMPACT OF GLOBALISATION ON INDIA:

- Globalization and greater competition among producers - both local and foreign producers - have been of advantage to consumers. There is a greater choice before these consumers who now enjoy the improved quality and lower prices for several products. As a result, these people today, enjoy much higher standards of living than was possible earlier.

- MNCs have been interested in industries such as cell phones, automobiles, electronics, soft drinks, fast food, or services such as banking in urban areas. In these industries and services, new jobs have been created. Also, local companies supplying raw materials, etc. to these industries have prospered.

- Secondly, several of the top Indian companies have been able to benefit from the increased competition by investing in newer technology and production methods and raising production standards. Moreover, globalization has enabled some large Indian companies to emerge as multinationals themselves. Example: Tata Motors (automobiles), Infosys (IT), Ranbaxy (medicines), Asian Paints (paints), etc.

- Globalization has also created new opportunities for companies providing services, particularly those involving IT.

- However, the growth is not parallel amongst all sections. Batteries, capacitors, plastics, toys, tires, dairy products, and vegetable oil are some examples of industries where the small manufacturers have been hit hard due to competition; This is because it is cheaper to import the same products rather than buying the domestic ones at higher prices.

- Globalization and the pressure of competition have substantially changed the lives of workers. Faced with growing competition, most employers these days prefer to employ workers ‘flexibly’. This means that workers’ jobs are no longer secure

STRUGGLE FOR FAIR GLOBALISATION:

- Fair globalization would create opportunities for all and also ensure that the benefits of globalization are shared better.

- The government can play a major role in making this possible. Its policies must protect the interests, not only of the rich and the powerful but all the people in the country. Example: Proper implementation of labor laws, using trade and investment barriers wherever necessary etc.

- People can also participate in this through massive campaigns.

Market

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

MARKET

- We participate in the market as both producers and consumers. As producers of goods and services, we could be working in any of the sectors and as consumers; we participate in the market when we purchase goods and services.

- As you can see, there are certain rules and regulations that protects the workers from being exploited at the workplace.

- Similarly, to protect the consumers from being exploited, there are certain rules and regulations for the same.

- Exploitation in the marketplace happens in various ways. For example, sometimes traders indulge in unfair trade practices such as when shopkeepers weigh less than what they should or when traders add charges that were not mentioned before, or when adulterated/defective goods are sold.

- Markets do not work in a fair manner, especially when large companies are producing these goods. These companies with huge wealth, power and reach can manipulate the market in various ways.

- At times false information is passed on through the media, and other sources to attract consumers. For example, a long battle had to be fought with court cases to make cigarette-manufacturing companies accept that their product could cause cancer. Thus, rose the need for the protection of consumers.

CONSUMER’S MOVEMENT

- For a long time, it was the responsibility of consumers to be careful while buying the product.

- There was no legal system available to consumers to protect them from exploitation in the marketplace.

- It took many years for organizations in India, and around the world, to create awareness amongst people and to shift the responsibility from the consumer to the seller.

- In India, the consumer movement as a ‘social force’ originated with the necessity of protecting and promoting the interests of consumers against unethical and unfair trade practices.

- Rampant food shortages, hoarding, black marketing, adulteration of food and edible oil gave birth to the consumer movement in an organized form in the 1960s.

- Until the 1970s, consumer organizations were largely engaged in writing articles and holding exhibitions.

- They formed consumer groups to look into the malpractices in ration shops and overcrowding in the road passenger transport. More recently, India witnessed an upsurge in the number of consumer groups.

- In 1985, United Nations adopted the UN Guidelines for Consumer Protection, which worked as a tool for nations to adopt measures to protect consumers and for consumer advocacy groups to press their governments to do so.

- This led to building pressure on business organizations and the government. Thus a major step took place in 1986 by the Indian government i.e. the enactment of the Consumer Protection Act 1986, popularly known as COPRA.

Different rights

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

DIFFERENT RIGHTS

- After years of campaigns and awareness programs, there are certain rights that have been introduced to ensure that the consumers are not exploited. Let us look at them.

SAFTEY, INFORMATION, CHOICE

RIGHT TO SAFTEY:

- While using many goods and services, we as consumers, have the right to be protected against the marketing of goods and delivery of services that are hazardous to life and property.

- Producers need to strictly follow the required safety rules and regulations. There are many goods and services that we purchase that require special attention to safety.

- For example, pressure cookers have a safety valve, which, if it is defective, can cause a serious accident. The manufacturers of the safety valve have to ensure high quality.

- Public or government action is also required to see that this quality is maintained.

RIGHT TO INFORMATION

- Consumers have the right to be informed about the particulars of goods and services that they purchase.

- Consumers can then complain and ask for compensation or replacement if the product proves to be defective in any manner.

- These details are about ingredients used, price, batch number, date of manufacture, expiry date, direction for use, address of manufacture etc.

- For example, if we buy a product and find it defective well within the expiry period, we can ask for a replacement. If let us, say the expiry is not there, the manufacturer will shift the responsibility on the shopkeeper.

- Similarly, one can protest and complain if someone sells a good at more than the printed price on the packet. This is indicated by ‘MRP’ — maximum retail price.

- In October 2005, the Government of India enacted a law, popularly known as RTI (Right to Information) Act, which ensures its citizens all the information about the functions of government departments.

RIGHT TO CHOICE

- Any consumer who receives a service in whatever capacity, regardless of age, gender and nature of service, has the right to choose whether to continue to receive the service.

- You cannot be forced to buy any product from a particular vendor.

RIGHT TO SEEK REDRESSAL

RIGHT TO REPRESENT:

- The Act has enabled us as consumers to have the right to represent in the consumer courts.

Right to justice

- Books Name

- Understanding Economic Development Class-10

- Publication

- PathSet Publications

- Course

- CBSE Class 10

- Subject

- Economics

RIGHT TO JUSTICE

- As we previously studied, the consumer has every right to seek redressal. For this, certain simple steps have to be followed.

- The aggrieved person can first talk to the party that has done the misconduct.

- If the other party’s action is not satisfactory, the aggrieved person can take the matter into their own hands.

- The consumer can file a complaint before the appropriate consumer forum on his/her own with or without the services of lawyers.

- The aggrieved party has to fill out a registration form at the consumer court who then notifies the other party.

- At the court, the judge verifies documents, hears the arguments of both the parties, and then announces the verdict.

- The consumer movement in India has led to the formation of various organizations, locally known as consumer forums or consumer protection councils.

- They guide consumers on how to file cases in the consumer court. On many occasions, they also represent individual consumers in consumer courts. These voluntary organizations also receive financial support from the government for creating awareness among people.

- Under COPRA, three-tier quasi-judicial machinery at the district, state and national levels was set up for redressal of consumer disputes.

- The district-level court called District Forum deals with cases involving claims up to Rs 20 lakh.

- The state-level court called State Commission between Rs 20 lakh and Rs 1 crore.

- The national-level court — National Commission — deals with cases involving claims exceeding Rs 1 crore. If a case is dismissed in district-level court, a consumer can also appeal in the state and then in national-level courts.

LEARNING TO BE WELL INFORMED CONSUMERS

- When we as consumers become conscious of our rights, while purchasing various goods and services, we will be able to discriminate and make informed choices.

- However, how do we become one?

- The enactment of COPRA has led to the setting up of separate departments of Consumer Affairs in central and state governments. Through various means, the government spread information about legal processes, which people can use.

- Certain logos and certifications like ISI, Agmark, Hallmark, help consumers get assured of quality while purchasing the goods and services. The organizations that monitor and issue these certificates allow producers to use their logos provided they follow certain quality standards.

- It is not compulsory for all organizations but is mandatory for those products that can be hazardous to human lives. Example: LPG cylinders, food colours and additives, cement, packaged drinking water, etc.

- India has been observing 24 December as National Consumers’ Day. It was on this day that the Indian Parliament enacted the Consumer Protection Act in 1986.

- There are today more than 700 consumer groups in the country of which only about 20-25 are well organized and recognized for their work

- However, the consumer redressal process is becoming cumbersome, expensive and time-consuming.

- In most purchases cash memos are not issued hence, evidence is not easy to gather. Moreover, most purchases in the market are small retail sales. The existing laws also are not very clear on the issue of compensation to consumers injured by defective products.

- Despite the very shortcomings in the laws and implementation of the rules and regulations, we as consumers can make voluntary efforts by active participation in consumer movements.

PathSet Publications

PathSet Publications